Back-End Ratio

A key metric used by lenders to study the risk level of borrowers.

The back-end ratio is a key metric used by lenders to study the riskiness of their clients. It mainly identifies how much of a client's monthly gross income is used to settle their overall monthly debt payments.

If a client shows a high back-end ratio, it means much of their gross income is going towards covering debt which means they are less likely to manage their payments. In other words, it shows a risky client.

On the other hand, a low back-end ratio shows that debt payments are a small portion of a client's income. In this case, the client's risk of mismanaging their debt payments is low.

Usually, lenders look for a back-end ratio that is less than or equal to 36%. However, if a client shows an outstanding credit history or backup savings, the accepted percentage may increase up to 50%.

Formula

To calculate this ratio, you need to divide a client's total monthly debt payments by their monthly gross income:

Practical example

Let's dive into a practical example to illustrate how the ratio works. You're an analyst at Citigroup and you were asked to assess the riskiness of Sam, a new client applying for a personal loan.

Sam works as a teacher and earns $4,000 monthly. Sam has a couple of monthly debt payments:

- Credit card bills: $500

- Student loan: $200

- Mortgage loan: $600

- Other loans: $300

Thus, the total debt payments for Sam are $1,600 per month.

Following the formula provided above (back-end ratio = total debt payments/monthly gross income), we can calculate the ratio of Sam's debt payments to his monthly income:

Back-end ratio= 1,600/4,000= 40%

As most lenders desire a maximum ratio of 36%, you should not approve Sam's application since his back-end ratio exceeds your requirements by four percentage points. In other words, Sam may be a risky borrower due to his high debt payments.

If Sam loses his job for any reason, his debt will accumulate over the months, leaving him unable to finance his loan payments.

How to decrease the back-end ratio

There are two main ways one can lower it:

- Increase your monthly gross income

- Decrease your monthly debt payment

Let's use Sam's example illustrated above to assess the efficacy of these two methods:

1. Mathematically speaking, income is the denominator of the ratio, so the more it increases, the lower the ratio is going to be.

From a practical side, Sam will be earning more with his debt staying the same, so the debt will contribute to a lower fraction of his income, and he will be able to afford more debt payments.

Let's say Sam was able to contribute an additional $1,000 in monthly income by working extra hours as a tutor. His back-end ratio will drop to 32%. This will strengthen his loan application since his new ratio is below 36%.

2. Looking at the formula, decreasing total debt payments, which is the numerator of the formula, decreases the ratio.

In real life, any decrease in debt payments will liberate cash to be used in other activities.

Let's say Sam could decrease his loan debt by $200. Also, he was able to decrease his mortgage payment by $100 by a cash-out refinancing of his mortgage.

Thus, Sam's new total debt payments became $1,300. In this case, the back-end ratio will decrease to 32.5%, strengthening Sam's loan application.

3. Imagine if Sam could make both approaches. His new income would be $5,000, and his new total debt payments would be $1,300. In this case, the ratio will decrease dramatically to 26%, making his loan application excellent.

Front-end ratio vs. back-end ratio

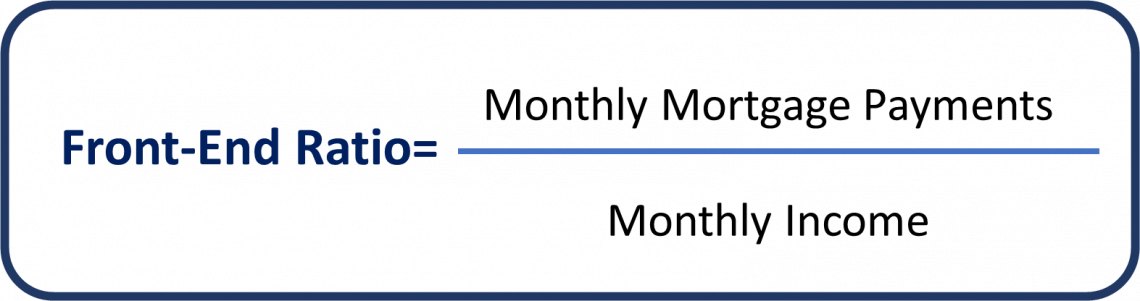

The front-end ratio also assesses the riskiness of borrowers, but it is specific to only one kind of debt. It focuses only on mortgage payments.

Similar to the back-end ratio, the front-end ratio shows the percentage of one's gross income going towards mortgage payments.

Lenders use the front-end ratio to measure the riskiness of potential borrowers. Like the back-end ratio, lenders desire a low front-end ratio, reflecting a borrower's ability to manage incremental mortgage payments.

Most lenders desire a front-end ratio that is lower or equal to 26%. However, borrowers' requirements may increase accordingly if a client shows outstanding credit records or high net worth.

If you wish to decrease your front-end ratio, you may either decrease your monthly mortgage payment or increase your income. As we mentioned in the previous section, Sam may decrease his mortgage payments by refinancing his mortgage or by looking for ways to generate extra income.

Going back to Sam's example, his front-end ratio would be calculated by dividing his mortgage payment by his monthly income:

$600/$4,000= 15%

It is crucial to mention that, given how much the front-end ratio ignores, lenders usually prefer to rely on the back-end ratio to assess their borrowers, as it shows a broader picture of their borrowing abilities.

- The back-end ratio is an indicator that assesses the riskiness of borrowers by indicating their monthly debt payments as a portion of their monthly income.

- It is calculated by dividing one's monthly debt payments by their monthly income.

- The front-end ratio is a more specific indicator, focusing only on monthly mortgage debt payments.

- The front-end ratio is calculated by dividing monthly mortgage payments by monthly income.

Everything You Need To Build Your RE Modeling Skills

To Help You Thrive in the Most Rigorous RE Interviews and Jobs.

or Want to Sign up with your social account?