GAAP Hierarchy

A common set of accounting standards, rules, and procedures.

Generally accepted accounting principles (GAAP) refer to a common set of accounting standards, rules, and procedures issued by the Financial Accounting Standards Board (FASB).

These standards encompass the details, complexities, and legalities of business and corporate and industrial accounting.

Its compliance makes the financial reporting process transparent and systematizes and regulates assumptions, terminology, definitions, and methods.

External parties can compare financial statements issued by GAAP-compliant entities and assume consistency, allowing quick and accurate inter-company and industrial comparisons.

Investors and stakeholders constitute a significant and essential part of any business. Their interest and confidence in the industry will determine their investment.

It's of utmost importance that an organization presents statements and reports transparently and continuously. This helps the investors and stakeholders to make sound and informed decisions.

The Financial Accounting Standards Board (FASB) was formed in 1973 as an independent nonprofit organization.

In the U.S., FASB is responsible for establishing and regulating the accounting and financial reporting standards for organizations and nonprofit firms.

In the U.S., public companies must follow GAAP when their accountants prepare and assemble financial statements. In addition, it helps the accounting world comply with general rules and guidelines.

The definitions, assumptions, and methods used across all industries for their accounting are generalized and standardized.

IFRS is a more internationally recognized standard. As a result, there have been efforts in recent years to transition from GAAP reporting to IFRS.

International Financial Reporting Standards (IFRS) are accounting standards that determine how particular types of transactions and events should be documented in financial statements.

They were developed and maintained by the International Accounting Standards Board (IASB).

The IASB's purpose is to ensure that the standards are applied globally to provide stakeholders and other users of the financial statements the ability to compare the financial performances of publicly listed companies.

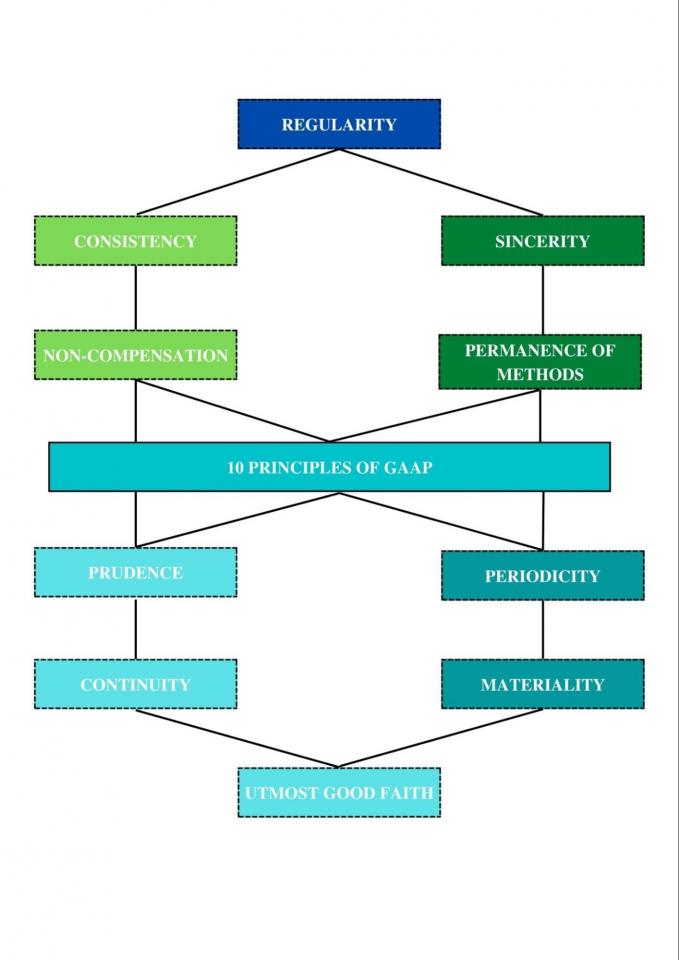

There are ten-key principles that GAAP includes. They are often compared with the IFRS, which are very principle-based standards.

GAAP Hierarchy: Principles

Below are the principles:

1. Principle of Regularity:

GAAP-compliant accountants stringently adhere to established rules, standards, and regulations.

2. Principle of Consistency:

Consistent standards are applied throughout the financial statements and their reporting processes. This uniformity is to ensure economic comparability between periods.

Footnotes in the financial statements are used to disclose and explain the reasons behind any changes or updates in the standards.

3. Principle of Sincerity:

GAAP-compliant accountants shall be committed to and for accurate and unbiased conduct. Accordingly, the accountant must strive to provide an accurate, impartial representation of the company's financial situation.

4. Principle of Permanence of Methods:

Consistent procedures must be used in the preparation of all financial reports. In addition, the techniques used in financial reporting should be consistent and uniform, facilitating a comparison of the company's financial information.

5. Principle of Non-Compensation:

The organization's positive or negative performance and all other aspects are reported with no consideration or prospect of compensation.

6. Principle of Prudence:

Speculation does not influence the reporting of financial data. This principle emphasizes fact-based financial data representation that is not clouded by speculation.

Accountants must disclose all financial data and accounting information in financial reports.

7. Principle of Utmost Good Faith:

All involved parties are assumed to be acting honestly. The Latin phrase "uberrimae fidei" is used within the insurance industry. It entails that parties remain honest in all transactions.

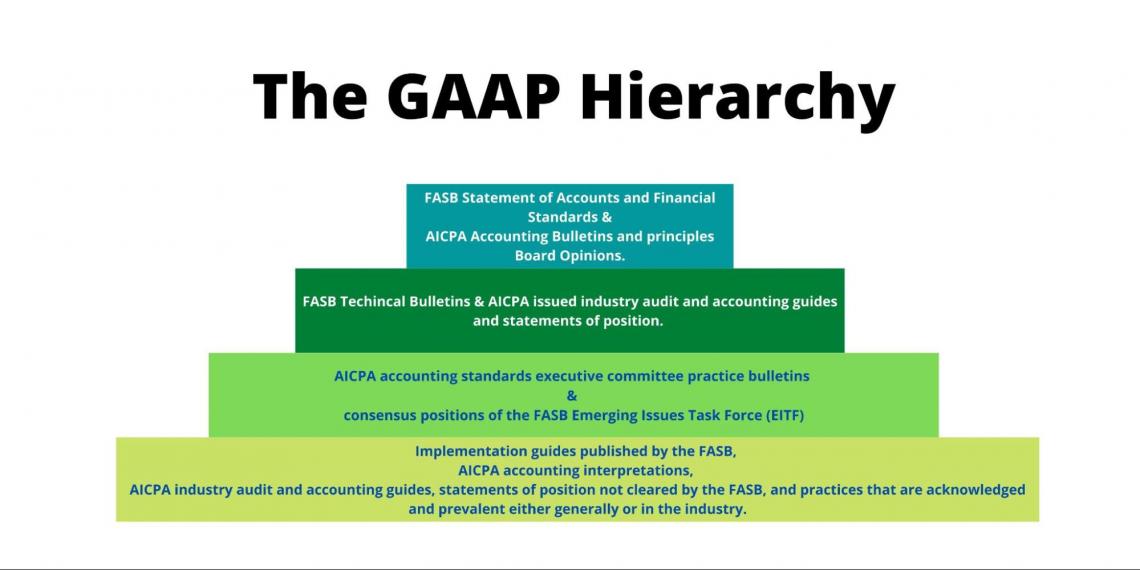

The Hierarchy

The GAAP hierarchy refers to the corresponding level of authority of accounting guidelines and principles under the Generally Accepted Accounting Principles.

The hierarchy defines the level of authority of different accounting assertions and rulings. Therefore, when researching an accounting issue and complication, the individual should look for relevant advice at the top of the hierarchy.

The hierarchy lays down the level of authority of accounting guidelines and principles under the GAAP that regulate accounting standards in the U.S.

The highest level of the hierarchy provides broad and general rules for accounting.

It was then descending and proceeding to account for research bulletins, statements, and guidelines not cleared by the FASB.

These rules apply to any firm/company/entity required to keep accounting records.

1. At level one, there are FASB's statements of financial accounting standards & interpretations, as well as AICPA accounting research bulletins and accounting principle board opinions that don't conflict with the ideas and performances of the FASB.

In situations where a conflict of guidance arises, the advice from the FASB supersedes all others in the hierarchy.

2. The second level of the hierarchy includes FASB technical bulletins, AICPA-issued industry audit and accounting guides, and position statements. These AICPA-issued guidelines are to be used only when cleared by the FASB.

The AICPA's Statements of Position aim to spell out and enhance accounting guidance and were later incorporated into the FASB's basic accounting standards.

3. The third hierarchy level comprises the AICPA accounting standards executive committee practice bulletins.

Then, the consensus positions of the FASB Emerging Issues Task Force (EITF) are discussed in Appendix D of the EITF abstracts.

More detailed guidelines are put forth in publications from the AICPA and the FASB. The governing AICPA documents at the third level are the timely issued accounting standards executive committee practice bulletins.

4. And at the final level of authority are the implementation guides published by the FASB.

This level also includes AICPA accounting interpretations, AICPA industry audit and accounting guides, statements of position not cleared by the FASB, and practices that are acknowledged and prevalent either generally or in the industry.

The accounting practices recognized and used in general accounting or within a specific industry or sector are included in the final level.

More detailed accounting information and guidance may not apply to all organizations within the lower hierarchy.

If there is no relevant information at the top of the hierarchy, the user works down through the different order levels until the relevant pronouncement is found.

A longer explanation of the hierarchy is contained within the FASB's Statement of Accounting.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

or Want to Sign up with your social account?