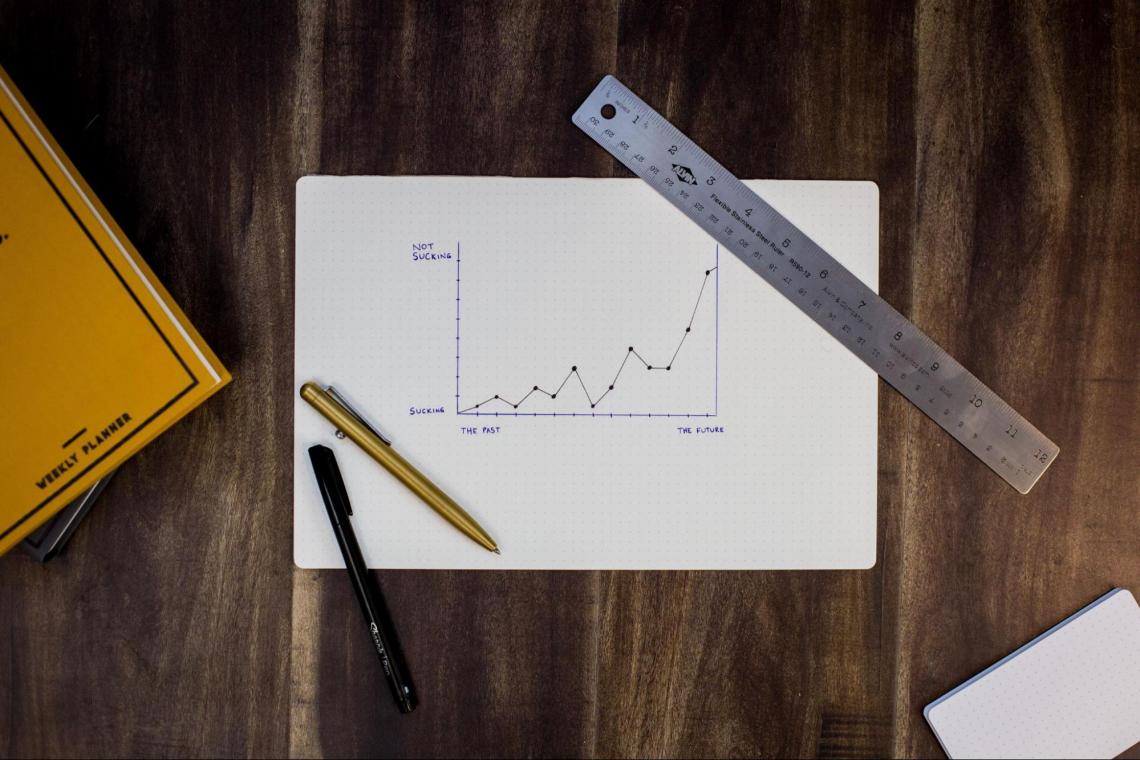

Impairment

Refers to a sudden, permanent loss of value

The underlying premise of IAS 36 is that an asset should not be carried in the financial statements at a value greater than the maximum amount that may be recovered through its use or sale. An asset is regarded as impaired if its carrying value exceeds its recoverable value.

The accounting process of depreciation (a reduction in the value of an asset throughout its useful life) may seem similar.

While there are some evident parallels between the two concepts, there is one crucial distinction: impairment refers to a sudden, permanent loss of value, whereas depreciation/amortization diminishes the asset's value over time.

Depreciation and amortization are commonly employed for ordinary wear and tear, whereas impairment losses account for exceptional declines in an asset's value.

A motor vehicle naturally depreciates and loses its market value over time, but the value of the said motor vehicle would plummet much faster than regular depreciation if it were to meet with a sudden accident causing permanent damage, for example.

IAS 36 was reissued in March 2004 and applies prospectively from the beginning of the first annual period commencing on or after March 31, 2004, to goodwill and intangible assets acquired in business combinations with an agreement date on or after that date.

IAS 36 applies to all except:

Inventories

Assets arising from construction contracts

Deferred tax assets

Assets arising from employee benefits

Financial assets

Investment property carried at fair value

Agricultural assets carried at fair value

Insurance contract assets

Non-current assets held for sale

Therefore, IAS 36 applies to (among other assets):

Land

Buildings

Machinery and equipment

Investment property carried at cost

Intangible assets

Goodwill

Investments in subsidiaries, associates, and joint ventures carried at cost

Assets carried at revalued amounts under IAS 16 and IAS 38

An organization must analyze whether there is any indication that an asset may be impaired after the conclusion of each reporting period (i.e., its carrying amount may be higher than its recoverable amount).

IAS 36 includes a set of external and internal indicators. If there is a possibility that an asset is impaired, the asset's recoverable value must be determined.

Whether or not there is any indication that they may be impaired, the recoverable amounts of the following types of intangible assets are measured periodically.

In some situations, the most recent thorough computation of the recoverable amount from a previous period can be used in the current period's impairment test for that asset.

Calculating the amount that can be recovered:

It is not essential to determine the recoverable amount if fair value minus disposal expenses or value in use is more than the carrying amount. The asset is not in any way impaired.

The recoverable amount is the value in use if fair value minus disposal costs cannot be calculated.

The recoverable amount for assets to be disposed of is fair value minus disposal charges.

Tangible assets

1. Fair value minus costs of disposal

IFRS 13 Fair Value Measurement is used to determine fair value. Disposal expenses are only the direct additional expenditures (not existing costs or overheads).

2. Value in use

The following elements should be considered when calculating the value in use:

A forecast of future financial flows

The entity anticipates gaining from the asset

Assumptions regarding potential changes in the quantity or timing of future cash flows

The current market risk-free rate of interest, which represents the time value of money

The cost of bearing the asset's inherent uncertainty

Other factors that market players might consider when pricing future cash flows, such as illiquidity

Cash flow projections should be based on acceptable and supported assumptions, the most recent budgets and forecasts, and extrapolation for periods beyond the budgeted projections.

Budgets and predictions should not exceed five years, according to IAS 36; for periods exceeding five years, extrapolate from previous budgets.

Management should examine the causes of variations between prior cash flow estimates and actual cash flows to determine the appropriateness of its assumptions.

Future restructurings to which the business is not committed, as well as expenditures to improve or enhance the asset's performance, should not be expected in cash flow predictions.

Cash inflows and outflows from financing operations, as well as income tax collections and payments, should not be included in future cash flow estimates.

The pre-tax rate should be used to calculate the value in use since it reflects current market estimates of the time worth of money and the risks associated with the asset.

The discount rate should not reflect risks for which future cash flows have been adjusted, and it should be equal to the rate of return required by investors if they were to choose an investment that would provide cash flows equivalent to those expected from the asset.

The discount rate is the rate an entity would pay in a current market transaction to borrow money to buy that specific asset or portfolio of assets if it were impaired.

If a market-determined asset-specific rate is unavailable, a proxy must be employed that takes into account the time value of money during the asset's lifetime, as well as country risk, currency risk, price risk, and cash flow risk.

Normally, the following would be taken into account:

The weighted average cost of capital of the entity

The entity's rate of incremental borrowing

Other borrowing rates on the open market

4. Recognition of an impairment loss

The loss is recognized when the recoverable amount is less than the carrying amount. It is recorded as a cost unless it relates to a revalued asset, where it is treated as a revaluation decrease.

Depreciation should be adjusted for future periods.

5. Cash generating units

If possible, the recoverable amount should be determined for each particular asset.

In determining the recoverable amount for an individual asset (i.e., the higher fair value, fewer costs of disposal, and value in use) is not achievable, establish the recoverable amount for the asset's cash-generating unit (CGU).

The smallest identifiable group of assets that generates cash inflows that are mostly independent of cash inflows from other assets or groups of assets is referred to as the CGU.

Goodwill

Goodwill should be tested for this annually.

Regardless of whether other assets or liabilities of the acquiree are assigned to such units, goodwill must be allocated to each of the acquirer's cash-generating units or groups of cash-generating units that are positioned to gain from the synergies of the combination.

Every year, goodwill should be assessed.

To determine whether goodwill is impaired, it must be assigned to each of the acquirer's cash-generating units or groups of cash-generating units that are expected to benefit from the combination's synergies.

This allocation is done regardless of whether the acquiree's other assets or liabilities are assigned to those units or groups of units.

Each unit or group of units to whom goodwill has been assigned must:

represent the lowest level of the organization where goodwill is tracked for internal management objectives;

Must not exceed the size of an operating segment defined by IFRS 8 Operating Segments.

A cash-generating unit with goodwill must be evaluated at least once a year by comparing the carrying value of the unit, including goodwill, to the recoverable amount of the unit.

The unit and the goodwill allocated to it are not damaged if the recoverable amount of the unit exceeds the carrying amount of the unit. The entity must recognize a loss if the carrying amount of the unit exceeds the recoverable amount of the unit.

The impairment loss is applied in the following order to reduce the carrying amount of the unit's (group of units) assets.

Lower the carrying amount of any goodwill attributed to the cash-generating unit (group of units) first, and then pro-rata on the basis, reduce the carrying amounts of the unit's other assets.

An asset's carrying value shall not be decreased below the highest of:

its fair market worth minus costs of disposal (if measurable)

its value in use (if measurable)

zero.

If the previous criterion is followed, it is then allocated pro-rata to the unit's other assets (group of units).

How is such a loss treated in the books of accounting?

As an example, consider a transaction between Dairy Queen and Nestle worth about $50 million. Dairy Queen's tangible assets, which include a production factory, delivery vans, and other equipment, were appraised at $25 million at the time of purchase.

Copyrights and patents worth $7 million are among its intangible assets. On Nestle Inc.'s balance sheet, the difference between the value of Dairy Queen's assets and the amount paid, i.e., $18 million, will be recorded as goodwill.

Dairy Queen's brand awareness, customer loyalty, and strong social media presence were deemed valuable by the corporation.

However, after three long years of declining sales, the corporation discovers that the value of the patents and copyrights obtained in the purchase of Dairy Queen is less than projected, so a $5 million impairment charge is recorded.

Depreciation and amortization have lowered the value of long-term assets by another $5 million over that time. As a result, the current book value stands at $40 million.

Due to uneven marketing and a lack of inventive new items, Dairy Queen has also lost numerous big distributors. As a result, the corporation incurs an extra $15 million charge as well.

Types of Triggering Events, Reversal of Impairment Losses & Disclosures

a) Triggering Events

According to experts, reviewing each asset regularly is futile. A more effective strategy is to respond rapidly to triggering events that indicate potentially negative effects on assets.

Of course, a company's capacity to identify such triggering events and mobilize a quick response is key to the strategy's success.

Hurricanes and other natural or man-made calamities are clear triggering events. Other triggers are less obvious, such as:

Obscure clauses in new or amended regulations,

Legal ramifications from lawsuits and other legal actions,

Rapidly deteriorating or long-term economic conditions,

Industry disruptors and technological obsolescence,

A brand-damaging scandal,

A major customer's bankruptcy or

Other correlative effects on operating cash flows or company profits.

Companies with good crisis management processes might add "evaluation of impaired assets" to their response plans as an action item.

b) Reversal of Loss

Assess whether there is any indication that a loss has lessened at each balance sheet date in the same way as impaired assets are identified. Calculate the amount that can be recovered if this is the case.

For the unwinding of the discount, there is no reversal.

If the loss had not been recognized, the higher carrying amount owing to reversal should not be more than the depreciated historical cost.

Unless it relates to a revalued asset, the reversal of a loss is recorded in profit or loss.

Depreciation should be adjusted for future periods.

It is illegal to reverse a loss for goodwill.

c) Disclosure by class of assets:

The impairment losses

are recorded in the profit or loss statement.

are reversed in profit or loss

which line item(s) of the statement of comprehensive income

on revalued assets recognized in other comprehensive income

on revalued assets reversed in other comprehensive income

d) Segment-by-segment disclosure:

Losses due to impairment recognized.

Losses on impairment reversed.

Other Disclosures

If an individual impairment loss (reversal) is significant, the following information must be disclosed:

Events and conditions that resulted in the loss

The extent of the loss or reversal

Individual asset: the type of asset and the market segment to which it belongs

Description of cash-generating units, amount of the loss (reversal) by asset class, and segment

If the recoverable amount is fair value with fewer costs of disposal, then a) the level of the fair value hierarchy, b) the valuation techniques used, and c) the key assumptions used in the measurement of fair value are all categorized within 'Level 2' and 'Level 3' of the fair value hierarchy.

If the total amount of the losses recognized (reversed) is significant to the financial statements as a whole, disclose:

Main asset groups that are impacted

Important events and situations

Key Takeaways

An asset is said to be impaired if its carrying amount exceeds its recoverable amount.

We should use pre-tax rates when discounting because they reflect the current market estimates of the time value of money and associated risks.

Risks for which future cash flows have been adjusted should not be reflected by the discount rate.

Rather, the discount rate should be equal to the rate of return required by investors if they choose an investment that would provide cash flows equivalent to those expected from the asset.

Immediate responses to events that potentially suggest negative implications for assets should be devised.

Tests on if the corporation's goodwill is impaired should only be conducted annually as many experts believe such attempts to calculate the amount of impaired goodwill regularly to be futile.

Goodwill must be assigned to each of the acquirer's cash-generating units or groups of cash-generating units that are expected to benefit from the combination's synergies.

Natural and/or man-made calamities are clear triggering events for the impairment of assets. Other triggers include customer bankruptcy, brand-damaging scandal, technology obsolescence, deteriorating economic conditions, legal actions, etc.

Information such as the events and conditions that led to the loss or reversal, the extent of the said loss, the type of asset (on which the loss has been incurred), and the market segment it belongs to, etc. should be disclosed if the individual loss amount is significant.

However, information such as important events and situations and major assets impacted should be disclosed if the amount of loss is significant to the financial statements as a whole.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

Researched and Authored by Sara Malwiya | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?