Lease Accounting

The method by which companies report the financial effect of agreements

The method by which companies report the financial effect of agreements to rent or finance the rights to use specified assets is known as lease accounting, also called leasing.

Lessees and lessors must now account for and disclose their leases in light of recent accounting rules.

The Financial Accounting Requirements Board (FASB) in the United States, (IASB) worldwide, and (GASB) for state and local governments in the United States all maintain lease accounting reporting standards.

The phrases "lessee" and "lessor" refer to the parties engaged in a lease contract. This distinction is critical because accounting as a lessor differs significantly from accounting as a lessee.

The core concepts of lessor and lessee did not alter when several accounting boards for local, foreign, and federal companies established new lease accounting rules.

However, the new lease regulations have changed part of the accounting treatment for lessors and lessees.

A lessee is an entity that pays a lessor for the use of a certain piece of property. When a person leases a car from a dealership, for example, the lessee is the one who drives the automobile.

The lessee effectively pays the lessor for the "right to utilize" the asset. This is why, under the new lease rules, the lessee must account for the lease as an intangible "right-of-use asset" (ROU asset) or "lease asset."

It's worth noting that this item is categorized as an intangible asset rather than a fixed asset on the lessee's records.

A lessor is an entity (i.e., a person, corporation, or organization) that provides the right to use an asset for a specific time in return for a fee.

One of the most prevalent leasing agreements involves an entity renting its after-is last property to another business in exchange for a monthly cash payment.

For example, if an organization owns a building and leases the right to use the building or a portion of the structure, the lessor, often known as the landlord, is the facility's owner.

Lessor Accounting for Capital Leases

When the carrying value and lease payments are the same, the lessor records a capital lease as a direct finance lease under US GAAP.

The lessor records a sales-type lease if the present value of the lease payments exceeds the asset-carrying value.

Four criteria establish whether a lease is a capital lease or an operating lease under ASC 840-25-1.

Upon signing the lease, this evaluation will be completed. Many businesses perform these four tests. Therefore we've summarized them below:

- The first condition is whether the title/ownership of the property passes to the lessee after the lease period.

- Second test: Is there a way to get a good deal?

- Third, is the lease period 75 percent or more of the asset's remaining economic life?

- 4th test: Does the present value of the total lease payments exceed 90% or more of the underlying asset's fair value?

ASC 842 provides a practical shortcut that allows a corporation to grandfather lease categories for leases that started before the shift.

The FASB has said that organizations who choose this practical expedient must verify that their accounting complies with ASC 840, as this expedient was not designed to allow companies to grandfather accounting mistakes.

As a result, while ASC 842 is in effect, lessees must understand their lease categories under ASC 840.

The lessor records both forms of financing leases in the following ways on its financial statements:

- The lessor presents the lease receivable on the balance sheet based on the present value of the lease payments.

- The lessor reports interest revenue based on the lease's receivables and the interest rate at the start of the loan on the income statement.

- The lessor reports the interest component as operating cash flow and the principal part as investment cash flow on the cash flow statement.

Finance (Capital) Lease Example

Skidz, Inc. signs a six-year leasing agreement with Bob's Construction Supply for a tower crane valued at $1,100,000. The crane has a seven-year usable life expectancy.

According to the contract, Skidz, Inc. will pay the lease payment at the end of each month for the next six years, with an implied annual interest rate of 12%.

There is no salvage value after the lease period. However, Skidz, Inc. will have the opportunity to purchase the crane for less than its fair market value (FMV). Skidz will pay a monthly fee of $20,000 (actual: $19,886.56).

The contract fits the following bright-line conditions for a capital lease:

- During the lease, Bob's Construction does not transfer ownership of the crane to Skidz, Inc.

- At the end of the lease, Skidz, Inc. has the opportunity to purchase the crane for less than FMV.

- The lease period is 6/7 of the crane's useful life (86%) instead of 75 percent.

- The current value of the monthly leasing rental is 94 percent, which is more than the required 90 percent.

The present value for computing lease payments is $1,034,000 at 94 percent. The total rent paid throughout the contract (72 months) is $1,431,832.

To calculate the interest, divide the total by the principal and interest charge:

Interest = Overall of 72 installments - Loan Amount Calculated

The crane's depreciation was divided into 72 monthly installments by the accountants. As a result, the crane's monthly depreciation is:

Depreciation = Present Value ÷ 72

= 1,017,205 ÷ 72 = 14,128$

Skidz, Inc. pays to clear the finance lease principal and interest over the 6-year loan under a capital lease accounting arrangement. In the lessee's books, the first period looks like this:

Lessor Accounting for Operating Lease

The lessor records the leased asset on the balance sheet and the interest revenue and asset depreciation on the income statement in operating lease accounting. The lease payment is shown as a cash inflow on the lessor's cash flow statement.

To qualify for an operating lease, a corporation must pass the operational vs. financing lease test. Compared to a financing lease, the lessor should be aware that an operating lease often means:

- Later years will see an increase in cash flow.

- In the beginning, it will have a lower cash flow.

- Its taxes are reduced in the early years of the operating lease.

In an operational lease, the lessee must recognize:

- The entire lease cost is allocated in a straight line throughout the lease term in each period.

- The lease payments that are not included in the lease liability are variable.

- Any asset with a right of use (ROU) impairment.

The lessor retains all of the asset's benefits and obligations in an operational lease. The lessee only utilizes the asset for a portion of its useful life.

Operating Lease Example

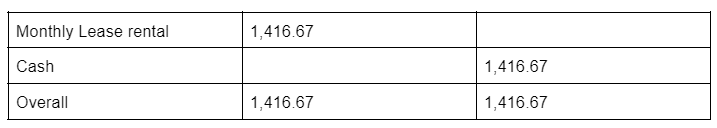

Trax, Inc. signs an operational lease deal for its warehouse facility, paying $17,000 in rent over 12 months.

Because this is an operational lease, Trax, Inc. will record the lease on its records in the same way for the whole year. Therefore, the cost of renting it every month is:

Monthly Rental Expense = (Overall Lease) ÷ Number of the Lease

= 17,000 ÷ 12 = 1,416.67

This transaction's journal entry is as follows:

When calculating the cost of an operating lease, the following pattern is used:

- A single lease cost is computed such that the remaining lease cost is allocated throughout the entire lease period on a straight-line basis (FASB).

- The interest charge and right of use (ROU) amortization will be combined into a single expenditure that will be recorded on a straight-line basis.

- The plug technique is used to calculate the ROU amortization.

- Divide the undiscounted payments by the lease duration to get the straight-line lease expenditure.

Lease Accounting Standards Changes

The FASB issued Topic 842, a lease accounting standard update (ASU 2016-02), in 2016. For practically all leases, the new standard requires lessees to identify ROU assets and lease liabilities on their balance sheets.

See Critical Lease Accounting Terms to Know for ASC 842/IFRS 16 Preparation for additional information on ROU and lease liabilities. Denise Hozza, Director at Concannon, Miller & Co., P.C., has 23 years of experience in public accounting.

Corporations previously expensed rent or lease payments on the income statement without ever appearing as an asset or liability on the balance sheet.

These accounting rules also imply that most operating leases must now be capitalized on the balance sheet rather than reported in the footnotes. However, leases must still be classified as operating or financing on the income statement.

This rule does not apply to short-term leases, which last less than a year. ASC 840 was superseded by the new standard, which closed the critical loophole of off-balance sheet operating leases.

The new lease standard went into effect for public firms in January 2019. But, numerous organizations have sought for the timing for other issuers to be postponed (private and small reporting companies).

The American Institute of CPAs publicly requested that FASB postpone the implementation date to May 2019, calling lease accounting important and challenging.

The Accounting Standards Board (FASB) and the International Financial Reporting Standards (IFRS) will now take effect in 2021 for private and small reporting enterprises as a consequence of this endeavor.

The most important thing to know about the revisions is that the new lease rules might negatively impair a company's financial covenants.

The increased obligation to declare liability for funded and operating leases might cause the corporation to fail to meet any debt-based calculated covenants.

The majority of regulatory changes are reflected in companies' balance sheets. Additionally, businesses must verify that:

- The calculated value of their lease payments is used to determine the asset and liabilities.

- The discount or incremental borrowing rate calculates the lease's present value.

- If the lease is for 12 months or less, it is not considered an asset or liability.

IAS 17 Changes to IFRS 16

New lease accounting standards, IFRS 16, were established by the International Accounting Standards Board (IASB), which replaced IAS 17. These converge with the FASB's GAAP lease accounting guidelines (called day one) for lease beginning.

The IASB and FASB have slightly different accounting for leases on day two.

These new laws make dual-reporting corporations' lives more difficult in the United States and abroad. International regulations are currently adopting the single lessee accounting concept.

To comply with multiple frameworks, dual reporters may need to use distinct processes and accounting systems.

After day one, the following are the variations between international and U.S. rules:

- All leases are treated as financing arrangements under the new IFRS 16 regulations.

- Only finance leases are considered financing arrangements on the income statement under ASU 2016-02.

- The lessee reports assets and liabilities on the balance sheet, but day two accounting will result in a straight-line total leasing expense.

IAS 17 Example

IAS 17 employs the principle of a substance above form in lease accounting.

For example, George Betts, Inc. decides to lease a digger with four years of remaining usable life for $5,000 per year for four years (paying at the end of each year) rather than buy it outright for $14,275.

George Betts, Inc. will have paid $20,000 in rent and will return the digger to the leasing firm after four years. After the lease, there will be no salvage value.

The interest rate on loan is 15% per year.

This is a finance lease, according to IAS 17, because the asset will have no remaining useful life at the end of the four-year lease.

The fair market value of the digger (as PPE) is recorded in the starting journal entry, and the cost of yearly usage is split in the depreciation journal entry.

By implementing ASC 842, the FASB hopes to promote openness and comparability across diverse organizations. As a result, some businesses may need to amend their present lease agreements to prepare for this transition.

At the very least, they should begin evaluating their contracts for businesses that wish to implement the new guidelines. First and foremost, be aware of the new criteria. Then decide which leases someone will need to register properly.

This criterion does not apply if the lease period is less than a year. However, if a corporation has a large number of leases, it will need to prepare how to record the transactions to meet the new requirement.

Review all service agreements and examine them in case some elements come within the definition of a lease and someone has to cut them out from the main contract.

The corporation may have to get rid of embedded leases. Leases that are embedded in service agreements are known as embedded leases. If the contract contains a lease, both parties should decide.

Companies should review their lease papers to determine if they fit under either finance or operating leases when operationalizing changes in financial records. Then they must document the lease terms to record them appropriately.

Other suggestions for corporations to consider as they prepare for changes in lease accounting laws include:

- Seeing if their current technology can aid in the organization of their transition process.

- Performing a gap analysis of lease data between the old and new standards.

- Creating a roadmap for implementation.

- Timelines and action plans for the transition are being prepared.

- Early application of the standards.

- Identifying an organization-wide transition team.

- Explaining the company's response and the regulatory modifications to stakeholders.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

Researched and authored by Fatemah Kamali | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?