Nasdaq Global Select Market

One of the three distinctive market tiers.

The three distinctive market tiers are the following, from the least stringent to the most stringent: the Nasdaq Capital Market, the Nasdaq Global Market, and the Nasdaq Global Select Market.

Each of the three tiers has specific financial, liquidity, and corporate governance requirements that companies must satisfy to complete their initial listing.

Being listed on Nasdaq Global Select Market, which contains the highest listing standards, is often viewed as a significant achievement and a sign of status.

Companies, including direct listing ones, must meet all the criteria of at least one of the four financial requirements standards and four liquidity requirements applied to the Nasdaq Global Select Market.

The financial standards are earnings, capitalization with cash flow, capitalization with revenue, and equity assets.

The liquidity standards are IPOs and spin-off companies, direct listing with a capital raise, or seasoned companies currently trading common stock or equivalents, direct listing, affiliated companies, and listing rule.

On the other hand, the Nasdaq Global Market and Capital market have more applicable requirements for smaller companies and monetary value.

More info can be found in the listing center.

Financial requirements

There are four standards under the financial requirements, and a company must at least satisfy all the terms under one of the standards.

The earnings standard of the financial requirements comprises the following: the company's aggregate pre-tax income must be ≥ $11 million in the prior three fiscal years and must be ≥ $2.2 million each of the two most recent fiscal years.

By Capitalization with Cash Flow: The company must have aggregate cash flows ≥ $27.5 million in the prior three fiscal years, market capitalization ≥ $550 million on average, and a revenue ≥ $110 million in the last fiscal year.

By Capitalization with Revenue: The company must have a market capitalization ≥ $850 million over the prior 12 months and revenue ≥ $90 million in the previous fiscal year.

By Assets with Equity: The company must have a market capitalization ≥ $160 million, total assets ≥ $80 million, and stockholders' equity ≥ $55 million.

For each standard, the bid price is the same -- a minimum of $4.

Liquidity requirements

There are four categories under the liquidity requirements, and a company must satisfy all the terms under at least one of the categories.

For initial public offerings and spin-off Companies:

- 450 unrestricted round lot shareholders or 2,200 total shareholders

- 1.25 million unrestricted publicly held shares

- $45 million market value of unrestricted publicly held shares or $45 million market value of available publicly held shares plus stockholders' equity

For a direct listing with a capital raise or seasoned companies:

- Four hundred fifty unrestricted round lot shareholders or 2,200 total shareholders or 550 total shareholders and 1.1 million average monthly trading volume over the past year.

- 1.25 million unrestricted publicly-held shares

$110 million market value of unrestricted publicly held shares or $100 million market value of available publicly held shares and $110 million stockholders' equity.

For direct listing companies, the requirements are the same as directly listing right above, except that there is one additional requirement. There must be a valuation by an independent third party of $250 million market value of publicly held shares.

For affiliated companies:

- There must be 450 unrestricted round lot shareholders or 2,200 total shareholders or 550 total shareholders, and 1.1 million average monthly trading volume over the past 12 months

- 1.25 million unrestricted publicly held shares

- $45 million market value of unrestricted publicly held shares

What are some Nasdaq Global Select Market companies?

There are around 1,700 companies currently in the Nasdaq Global Select Market, categorized by market capitalization (ranging from $200 billion to $50 million), analyst rating, sector, region, and country.

There is a wide range of companies listed on Nasdaq. It is also a "target" stock exchange for information technology, innovation, and biotech companies, such as Apple, Google (Alphabet), Facebook (Meta), BioNTech, etc.

The benefits of listing with Nasdaq include brand alignment, visibility, efficient executions, shareholder engagement and intelligence tools, public policy advocacy, and effective corporate engagement.

Compared to NYSE, companies listed on the Nasdaq are usually smaller but more growth-oriented.

One significant advantage is the lower listing cost. The initial listing fee for the Nasdaq Capital Market is $50,000 - $75,000, and the all-inclusive annual listing fee ranges from $45,000 to $81,000. For the Nasdaq Capital Market, it is $40,000 to $79,000.

The initial listing fee for the Nasdaq Global and Global Select Market is $150,000 - $295,000, and the all-inclusive annual listing fee ranges from $48,000 to $167,000.

On the other hand, the NYSE has an initial listing fee at a flat rate of $295,000 and an annual sustaining fee starting from $74,000.

The initial listing and annual sustaining fees are more expensive than what Nasdaq charges, so companies listed with the NYSE are more often prestigious with large market capitalizations.

Among those the mega-sized (>$200 billion) companies are the well-known ones -- Apple, Microsoft, Alphabet (Google) Class C and Class A, Amazon, Tesla, Meta, Nvidia, Pepsi & Co, Verizon, and Broadcom.

Note how the stock price varies from company to company, and the differences in the number of stocks offered are one of the critical factors.

Notice how Apple's stock price is around $130, and Alphabet's Class C shares are $2100+; however, Apple's market cap is more than $2.2 trillion, and Alphabet's market cap is about $1.4 trillion (June 2022).

For more information, you can refer to the stock screener.

NASDAQ Global Select Market Composite

The Nasdaq Global Select Market Composite is a stock market index that contains all the stocks listed on the Nasdaq Global Select Market, weighted by their market capitalization or the number of shares multiplied by the stock price.

A stock market index measures the performance of stocks from different companies together, rather than individual stocks. Such an index allows people to track and invest in significant diversified funds.

The Nasdaq Index started in July 1984, with 100.00 as its base value. This index allows investors to track the overall performance of the Global Select Market Tier just as they would track an individual stock.

The Nasdaq Global Select Market Composite is called an index fund. An index fund is a kind of mutual fund with broader market exposure, lower operating expenses, lower portfolio turnover, and a passive investment strategy.

Because the index has multiple stocks, there is greater diversification, allocating investments across various financial instruments, sectors, etc., reducing the risk of losing all your money in a single investment.

Some other commonly-known index funds are the S&P 500 index, Wilshire 5000 Total Market Index, Bloomberg US Aggregate Bond Index, MSCI EAFE Index, and Dow Jones Industrial Average (DJIA).

Market Capitalization

Market capitalization is the value of a publicly traded company's outstanding shares (shares that are bought and sold in public markets). In other words, it is the share price multiplied by the number of shares outstanding.

Market capitalization is essential as it acts as an indicator of the public opinion of a company's net worth making it one of the factors contributing to stock valuation. In addition, it reflects a company's equity value (asset - liability).

There are typically three categories of market capitalization based on company sizes: large-cap with a market value of ≥$10 billion, mid-cap with a market value between $3 billion to $10 billion, and small-cap with a market value less than $3 billion.

Large-cap companies usually act more cautiously than smaller-cap companies because the former aims for slower but stable growth.

Why may you ask? Large-cap firms have already reached a particular size and level of revenue growth, allowing them to shift their focus from expansion to maintaining and slightly improving upon their current performance.

On the other hand, small-cap firms seek to increase market share and maximize their performance, meaning they often expand at a surprising speed but are more volatile due to competition and less available capital support.

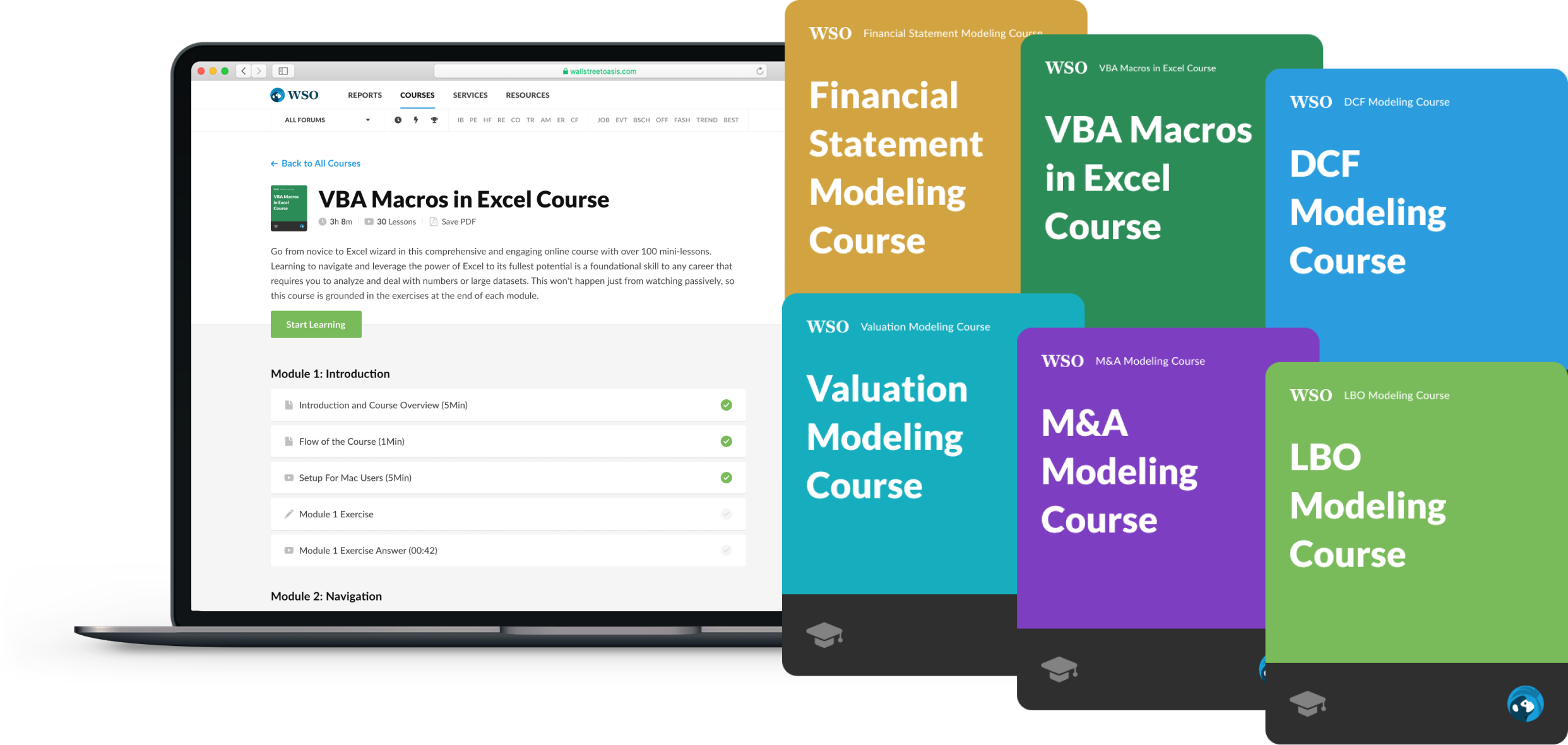

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and authored by Amy Liu | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?