Order Book

A register of all present, and past buy and sell orders transacted for a particular security.

An order book is a register of all present and past buy and sell orders transacted for a particular security.

It is recorded electronically in the modern age, providing fast and precise data about market positions and prospects. In addition, traders use this book as a technical tool to observe market speculation.

The network's performance determines the speed at which trading firms receive the data.

Trading firms with fast data transmission can execute their stock orders rapidly, relying on computer algorithms to interpret the incoming data and output calculated orders.

Firms compete for the fastest network and most reliable algorithm to collect and interpret order book data. This is because it can place one firm ahead of the others in terms of executing orders at the earliest price before a profitable market movement occurs.

What is an order book?

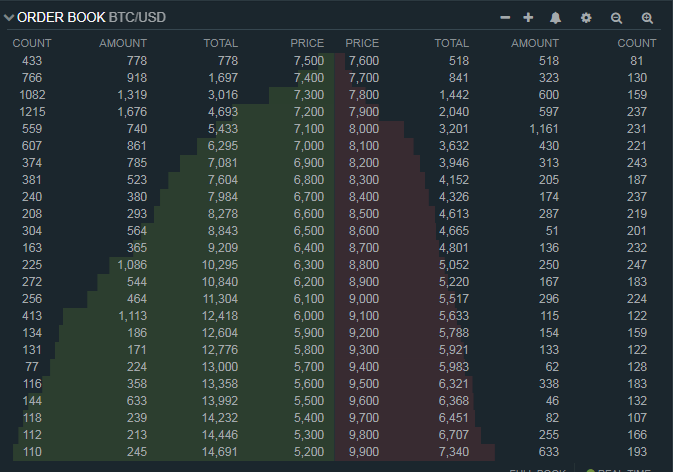

The book details the price point, the number of units, and the cumulative total of units bought at a price point.

The data can be provided as a visual representation, a chart, or a graph, so it is easy to comprehend.

The buyers (on the left) and sellers (on the right) can be easily compared with the order book formatted above. For example, there are 778 buy orders at $7500 compared to the 518 sell orders at $7600.

The total accumulates the number of units that would have been bought or sold at a specific price point. Visible at the $7400 where the total is 1697, as the 778 units at $7500 are added with the 918 units at $7400.

These are available for common stocks, commodities, forex, and cryptocurrencies. In addition, as cryptocurrencies are traded on digital exchanges, they provide an open order book of all transactions.

The price points of both buyers and sellers inform analysts about the bid-ask spread. A bid is a price a potential buyer says they're willing to pay, while an ask is a price a potential seller says they're eager to sell for.

The bid-ask spread is the difference between the highest price a participant is willing to purchase a security and the lowest a participant is willing to sell a security. It is a parameter of supply and demand.

High demand would create a narrow bid-ask spread, while low demand would do the opposite. It is also a measure of liquidity as a narrow bid-ask spread suggests that there is potentially a buyer for every seller, hence high liquidity.

Market depth is a liquidity variable that measures the change in the price of a security according to the price orders and the trade volume.

A strong market depth would be represented by high liquidity, a narrow bid-ask spread, and a large volume of orders preventing large price fluctuations.

Price takers (traders) buy at the asking price and sell at the bid price, taking a small transaction cost from a narrow bid-ask spread. Market makers (financial brokerages) buy at the bid price and sell at the asking price, generating profit from the spread.

How are these used?

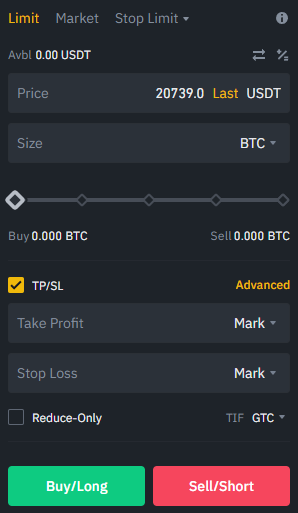

Order types:

- Market order - The purchasing or selling of a security at the real-time price for an immediate transaction.

- Limit order - This involves a trader picking a specific price to complete an order at, with the order filling once the real price of the security agrees to the condition.

- Stop-loss order - A trader determines a price. Once that price is hit, the position will close, preventing excessive losses.

- Take-profit order - An order with a set price determined by a trader that closes the position once the price is reached. These are used when a trader decides at which point they are satisfied with the return or believe the market could decline after reaching a certain price.

- Trailing-stop order - These orders close the position after a certain percentage decline, stopping excessive loss. The trailing stop is calculated from the price peak until the market decline percentage condition is actual.

Source: Binance (cryptocurrency exchange), Order terminal, 2022, www.binance.com

As the order book is electronically updated, it provides a continuous feed about market volumes and prices that investors can use as part of their trading strategy.

A large volume of buyers at a particular price point can help identify supports where the market could rebound after a decline. It would benefit the investor to enter the market at a relatively low price to maximize returns.

Likewise, a large volume of sellers at a particular price point can identify resistance, where the market can retrace a bullish momentum. This can advise traders where to place a take-profit order to maximize profits in a market downturn.

The order book promotes market transparency, making information available to everyone and allowing retail and institutional trades to be monitored.

However, "dark pools" can hide their identity. They do this because if a big transaction were made by a large player and was known to the public, it could result in market positioning and manipulation to acquire large profits. This would disrupt the fundamentals of supply and demand.

Pros:

- It helps measure market sentiment - by viewing the volume and price of market orders to speculate the direction an asset may move.

- It is open and electronically available - transparency creates a fair advantage for all market participants, and the digital book enables a fast data output.

Cons:

- Trends can quickly change - with a high volume of orders being processed, it is likely for trends to be misjudged.

- An order book is not relevant for long-term investors - as the order book provides a short-term outlook of movement, it would not be informative to long-term investors.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?