REAL ESTATE MODELING BOOTCAMP - 4 HOURS

Introducing...

WHAT YOU’LL GET IN THIS VIRTUAL BOOTCAMP

Get Taught by The Best

Taught and vetted by actual industry professionals. Understand key real estate modeling theory and mechanics and learn the three primary types of CRE strategies and the structuring deals. Course content is continually reviewed and updated.

Master Excel Shortcuts

Learn how to save time and enhance productivity, establishing trust and stability of senior team members by demonstrating an excellent grasp of Excel. As an analyst or associate, you will "own" the model.

Best Practices

Learn the things you should and should not do on the job to make sure you're presenting yourself and your work in front of colleagues and senior team members in the best light possible. We go over common mistakes and errors analysts and associates make starting out and give tips to put yourself in a better light.

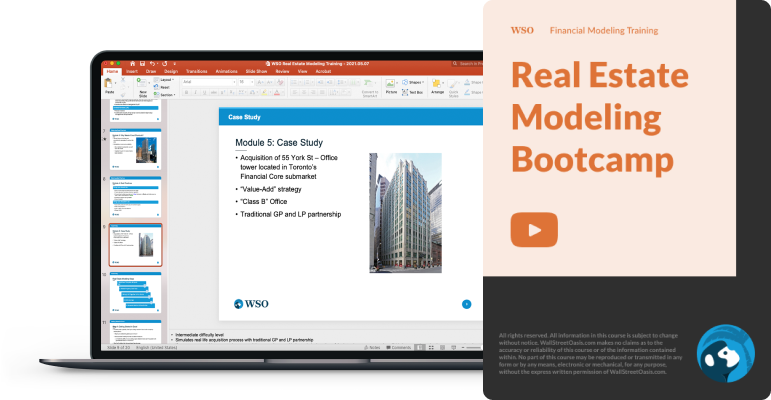

Case Study

Put everything you learned in practice with a step-by-step walkthrough of the 55 York St. Acquisition case study. You will learn and apply the five steps of Real Estate Modeling, use a third-party software called Argus, calculate key metrics, and conduct sensitivity analysis. We wrap the case study up by providing our final investment thesis to the investment committee.

Topics Covered

Below you will find a list of the topics covered in the RE Modeling Bootcamp.

- Core

- Value-Add

- Opportunistic

- General Partner (GP) or Sponsor

- Limited Partner (LP)

- Things you should do

- Things you shouldn't do

- Step 1: Getting Started in Excel

- Step 2: Modeling Property Cash Flow

- Step 3: Bringing it All Together in Excel

- Step 4: Add Leverage

- Step 5: Calculate Key Metrics, Sensitivity Analysis, Promote

Our students have landed and thrived at positions across all top Real Estate firms, including:

Don’t Take Our Word For It

Here are just a few of the candidates who have been trained for RE modeling by WSO...

Here are just a few of the candidates who have been trained for RE modeling by WSO...

"I like the course in general. It gives a good overview of real estate modeling with interesting examples. The course gave me insight in how to categorize incomes and expenses in a neat and structured way."

"Not having any exposure to Real Estate Financial Modeling, I found the videos to be helpful to listen to, Austin does a great job explaining what he does in each video segment. As someone who just graduated in May and taking no real estate courses in college (majored in Finance), it was easy to understand...Overall the course was great, it's very informative and saved me a lot of time from not having to look up in-depth and try to read how to make a financial model for different properties."

"I really enjoyed the course because of how detailed the modeling was and that the instructors provided a number of different cases covering a wide range of asset classes. The instructions were easy to understand, and speaking as someone who had worked in real estate in the past, I can testify that the models are detailed and practical in the actual work of a real estate fund."

"Since I have very little prior knowledge of real estate modeling, this first course already helped me to understand the basic concepts of this modeling approach. The instructor has a very good way of explaining the excel build and the links between different parts of the model."

How Much is Your

Finance Career Worth?

What You Get | Value |

|---|---|

WSO Real Estate Modeling Bootcamp 4 hours of live instruction taught by an elite Real Estate professional... | $997 |

Interactive Modeling Case Study from Real life with Templates Realistic practice drilling the concepts with an actual modeling test you see in the toughest RE interviews... | $449 |

TOTAL VALUE | $1,446 |

Attend the 4-Hours Real Estate Modeling Virtual Bootcamp For 86% Off

$1,446

$197

Secure checkout

Frequently Asked Questions

Top professional with RE experience

- Top Elite boutique

- 10+ Years of direct RE investment experience

- MBA Students and Business Undergraduates

- Incoming Real Estate Investment Analysts and Associates

- Incoming Private Equity Associates/Analysts

- Investment Banking Analysts and Associates

- Corporate Finance Professionals

- Taught and vetted by actual industry professionals

- Course content continuously reviewed and updated

- Prepare to excel across all aspects of Real Estate Modeling

- Understand key Real Estate theory, mechanics and apply them in practice

- Please check out our Events page for more details

- Live-instruction conducted through Zoom

-01.png)