Warrant

A derivative instrument.

The term refers to a derivative instrument issued by the issuer of the underlying securities or by a party other than the issuer of the underlying securities.

It entitles the holder to buy or sell the underlying securities to the issuer at an agreed price within a given time frame or on a particular expiration date.

A warrant is a marketable security tied to a financial derivative product (instrument) that is the underlying security, which is the evidence of a right (but not an obligation) for the holder.

A financial derivative instrument containing an expiration date, an exercise price, or other execution conditions is referred to as a "Warrant" in the securities market.

The New York Stock Exchange defines it as an option to buy or sell the underlying asset (the underlying asset) at a predetermined price and time (or at a comparable price over a period of time stated in the agreement).

It generally refers to marketable security that has been issued by the issuer with certain conditions in a broad sense. They are essentially a contract of rights from a legal standpoint.

Investors who have paid premiums to purchase have the option to subscribe for or sell certain warrants at the exercise price within a predetermined time frame-the underlying asset's quantity.

What is it?

Like options in derivatives, what the warrant holder obtains after paying the premium is a right but not an obligation, and whether he/she exercises it or not is at the discretion of the holder.

When requested, it should be exercised. In short, it is a right: an investor can subscribe for or sell the underlying asset at an agreed price during an agreed period or expiry date.

These are securities that may be issued by the same entity that issued the underlying securities or by a different party, such as investment banks or securities firms.

There are two alternatives to buy (call) and sell (put) the underlying asset included in the rights represented by this type of right.

The holder has the option to buy or sell it to the issuer at the agreed performance price within the predetermined performance period or on a predetermined expiration date after the investor pays a set portion of the premium to the issuer.

The difference could be resolved in cash against the underlying securities.

In other words, a subscription (sale) warrant is a certificate for the right to purchase (sell) the underlying securities and is a privilege rather than an obligation.

The issuer of the subscription (sell) warrant may not object when the right is exercised. The types of securities that have been listed on the exchange as indicated by the issuer when the warrants are issued are the underlying securities that are referenced here.

It is a security or an asset that the issuer offers to purchase from or sell to the holder, subject to previously agreed-upon terms. It could be an index, portfolio, stock, fund, or bond.

An organization, such as an issuing firm or a securities company of the underlying securities, acts as the issuer. The premium is the cost an investor pays to the issuer to buy it.

Basic Definition

For instance, after you pay a particular sum of money, the issuer grants you a right. The holder of this right may purchase or sell a security from the issuer a predetermined number of assets at a predetermined price at a future date or time.

There are two different types: European-style and American-style.

- European warrants are those that can only be used on the day of expiration.

- American warrants are those that can be exercised at any moment before their expiration date.

Call warrants belong to "call options" among options, and put warrants belong to "put options."

Its value consists of two types; one is intrinsic value, that is, the difference between the underlying stock and the exercise price.

The other is time value, which represents the holder's expectations and opportunities for future stock price fluctuations.

Other conditions are the same; the longer the duration, the higher the price.

Call warrant value = (stock price - exercise price) * exercise ratio

Put warrant value = (exercise price - underlying stock price) * exercise ratio

Differences between the two major types of warrants

For holders of tradable shares, call warrants and put warrants have the following differences:

1. The risk of having "underlying stock + warrants" is different:

Due to the distinct sensitivity of call and put warrants to the underlying stock, if the underlying stock price increases, then the value of call warrants increases as well, whereas the price of put warrants decreases.

According to the sensitivity of the combination, call warrants will increase the portfolio's systematic risk, whilst put warrants will somewhat offset that risk from changes in the price of the underlying stock.

2. Stockholders of marketable shares receive a different reward:

The price of the put warrant will rise when the price of the underlying stock declines, making up for the shareholders of the tradable shares' losses and lowering their break-even point.

Likewise, the call warrants may allow the holders of the tradable shares to participate in potential future performance growth. However, if the stock price is reduced, it won't be able to offer the holders of tradable shares anything in the way of immediate compensation.

3. There is a difference in the maturity value:

Due to the fact that all of it included in the present share reform plan is delivered through stock settlement, it will significantly affect its expiration value.

When a put warrant is about to expire, it being an in-the-money, meaning that the stock price is lower than the exercise price, then the holder will unavoidably purchase the underlying stock in order to exercise the option. This buying pressure could lead the stock price to rise.

For call warrants, if they are in the money during the expiry period, the holder needs to have cash on hand to purchase stocks from the main shareholder at the exercise price and will not be interested in it.

The number of tradable equities on the market, however, dramatically rises after the option is exercised. This is due to the fact that when it is exercised, it leads to the issue of new equity shares with the holder being the holder.

The underlying stock will see short-term selling pressure if investors desire to grab profits as quickly as feasible. As a result, the stock price will unavoidably drop once more, costing investors money.

4. Put warrants allow investors to build a variety of investment portfolios:

While call warrants can only become a tool for speculators to speculate in the absence of a short-selling mechanism in the market, put warrants have characteristics that investors can build a range of different investment portfolios.

Warrant Pricing

The Black-Scholes model is widely used for pricing. This model has developed over decades in the overseas options and stock markets. The model has been tested and proven to be mature and effective.

The BS model is derived from the principle of risk-free arbitrage, which means that if the price of a warrant deviates from the value calculated by the BS model, there will be an opportunity for risk-free arbitrage, and the process of risk-free arbitrage will make it.

The price returns to the theoretical value calculated by the BS model. That is, it is a financial derivative product that can be copied by holding certain underlying securities and bonds, and they can also hedge risks through the opposite process.

However, some factors in the real-world market will cause the price of warrants to deviate from the theoretical value calculated by the BS model.

The factors mainly include the inability of continuous transactions, the existence of hedging costs and transaction costs, etc.

This is also the reason why the price of warrants is usually higher than the real fluctuations. The reason for the higher BS value is calculated by the rate.

Therefore, the price of it cannot be completely determined by the BS model but depends on the relationship between supply and demand, but the theoretical value calculated by the BS model is definitely a reference.

Key Elements of Warrants

There are nine key elements:

1. Issuer

The issuer of equity warrants is the target listed company, while the issuer of derivative warrants is a third party other than the target company, generally a major shareholder or a securities firm.

In the latter case, the issuer is often required to deposit the underlying securities with an independent custodian as security for the performance of its obligations.

2. Call and put warrants

A call warrant is when its holder has the right to purchase the underlying security from the issuer. Conversely, when the holder has the right to sell the underlying securities to the issuer, it is a put warrant.

3. Expiration date

The expiry date is the last date on which the holder can exercise the right to subscribe (or sell). After this period, the holder cannot exercise the relevant rights, and the value of the warrant becomes zero.

4. Execution method

Under the American-style execution method, the holder can exercise the subscription right at any time before the expiration date, while under the European-style execution method, the holder can only exercise the subscription right on the expiration date.

5. Delivery method

The delivery methods include physical delivery and cash delivery.

Among them, physical delivery refers to the purchase of the underlying securities from the issuer when investors exercise their rights to subscribe, while cash delivery refers to the issuer to investors when investors exercise their rights.

Pay the difference between the market price and the strike price.

6. Subscription price (exercise price)

The subscription price is the price set by the issuer when it is issued, and the holder subscribes to the underlying stock from the issuer at this price when exercising the right.

7. Warrant price

The price consists of two parts: intrinsic value and time value. When the underlying stock price (the market price of the underlying security) is higher than the subscription price, the intrinsic value is the difference between the two.

When the underlying stock price is lower than the subscription price, the intrinsic value is zero.

However, if it has not expired, the underlying stock price still has the opportunity to be higher than the subscription price, so it still has market value, and this value is time value.

8. Subscription ratio

The subscription ratio is the number of shares that can be subscribed for each. If the subscription ratio is 0.1, it means that every ten warrants can subscribe for one underlying stock.

9. Leverage ratio

The leverage ratio is the ratio of the underlying stock price to the market price of warrants required to purchase one underlying stock, namely: leverage ratio = underlying stock price / (warrant price ÷ subscription ratio)

The higher the leverage ratio, the higher the investor's profit rate, and the greater the risk of loss they may take.

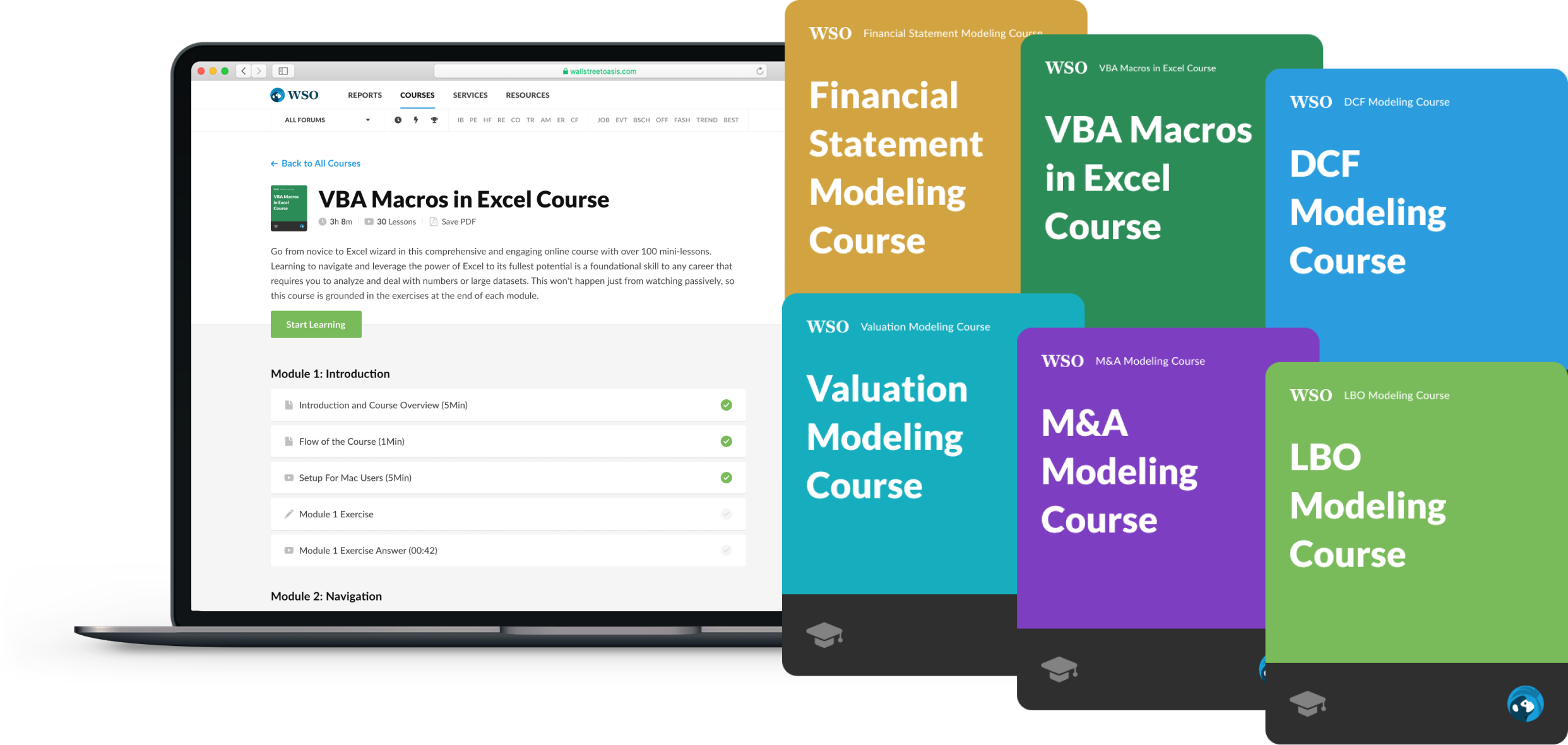

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?