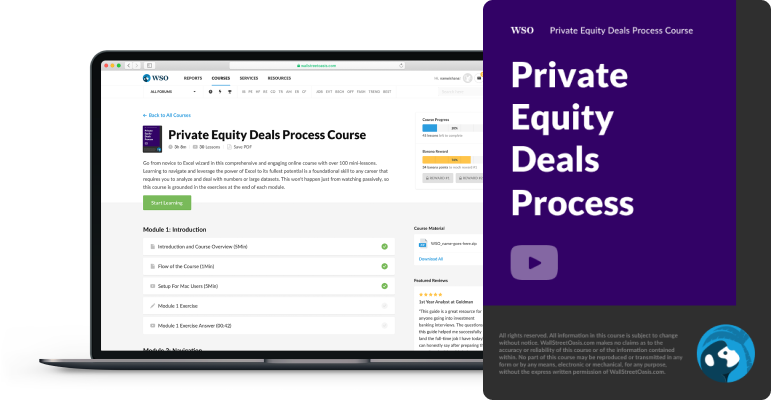

PRIVATE EQUITY DEALS PROCESS

Introducing...

Almost 200 Lessons across 9 modules, and 12+ hours of video lessons

To Help You Master Your PE Role...

PRIVATE EQUITY DEALS PROCESS COURSE INCLUDES

Private Equity Review (12 video lessons)

In this module, there are 12 video lessons provided to introduce you at a very high level to the world of private equity. You will be learning about the course objectives, what is private equity, where does the capital come from, the typical PE fund structure, a typical PE investment as well as an overview of the auction process and your role as a PE analyst and/or associate.

Initial Business Appraisal (11 video lessons)

In this module, we use 11 video lessons to get you comfortable with the first steps in an auction process. This includes real life example of NDAs along with best practices, a real world teaser as well as an introduction to the main case we will be using throughout this course, Banana Splits.

First Round Bids (31 video lessons)

In this module, there are 31 video lessons to walk you through 1) the process of reviewing CIMs 2) a real world CIM walk through 3) the CIM from our custom case that we will be using throughout the course 4) The buildout of our Mini LBO model from our case 5) The Investment Committee Memo overview 6) A real world lender indicative term sheet as well as a detailed walk through of the IOI process.

Conducting Diligence (17 video lessons)

The 17 video lessons in this module will help you understand the framework of diligence that you will be expected to lead in private equity. Learn about common third party diligence providers and take a detailed look at real world examples of 1) a diligence tracker in Excel, 2) a commercial diligence report 3) a financial diligence report 4) a tax diligence report as well as 5) common Quality of Earnings add-backs and key tips for managing these multi-track processes successfully.

Valuation and Financing (25 video lessons)

This module of 20+ video lessons takes a deep dive into our case underwriting model and our main LBO modeling assumptions to arrive at our various downside, base an upside scenarios. From a complex revenue build with a waterfall of unit types to build to top line projections to a variety of financing scenarios, learn how to build a complex but clean underwriting model that will give your deal team and the investment committee confidence in your projections.

The Final IC Memo and LOI (18 video lessons)

In this module, there are 18 video lessons that give you a detailed walk through of a real life Investor Committee ("IC") Memo and LOI. This module provides a walkthrough on IC memo returns, distribution waterfalls and other important considerations as the deal gets closer to the finish line.

The Close Process (11 video lessons)

In this module we use 11 video lessons to wrap up the deal and show the final steps needed to make sure there are no surprises in this critical phase to get the deal across the finish line. From funds flow to final GP bringdown, we have you covered.

Portfolio Company Monitoring (6 videos)

This brief module dives into the responsibilities of the associate post-close. This includes financial reporting, add-on acquisitions (modeling covered in LBO course), dividend recaps, exit timing considerations and more.

Distribution Waterfall Exercises (10 videos)

This module breaks down Distribution Waterfalls for you and discusses MOIC, non-compounding, and IRR hurdles using various examples.

WSO PE Deals Process Course - Video Preview

Course Summary - Table of Contents

Below you will find a list of the modules and lessons included in this course.

- Course Introduction

- Course Objectives

- What is Private Equity?

- Where does capital come from?

- How do PE firms make money?

- A Note on MOIC and IRR

- PE Fund Structure

- Typical Private Equity Investment

- The Deal Process: Auctions vs Proprietary Deals

- Auction Process Overview

- Sample PE Deal Funnel

- Roles & Responsibilities

- Banana Splits Introduction

- Initial Business Appraisal

- Banana Splits Teaser

- Real Teaser Example - Quick Review

- The Teaser: Questions to Answer

- Banana Splits Teaser - So What?

- Non-Disclosure Agreements (NDAs)

- Common NDA Clauses

- Real NDA #1 Review - Considerations & Highlights

- Real NDA #2 Review - Considerations & Highlights

- NDA Process: Best Practices

- Receipt of Process Letter and CIM

- The CIM Overview

- The CIM - Questions to Ask

- Real CIM #1 - Executive Summary and Key Highlights

- Real CIM #1 - Financial Summary, Competitive Positioning, Customer Concentration

- Real CIM #1 - Sales & Marketing Spend + Outlook + Capex

- Real CIM #2 - Key Value Attributes + Industry Trends

- Real CIM #2 - Brands-Products + Business Model

- Real CIM #2 - Financials

- Case CIM - Summary

- Case CIM - Investment Highlights

- Case CIM - Highlight Details

- Case CIM - Management

- Case CIM - Growth + Industry Trends

- Case CIM - Competition + History

- Case CIM - Unit Detail + Pipeline Sense Checks

- Case CIM - Key Hires + Financials

- Mini Model Overview

- Mini Model Components

- Mini Model - Excel Setup

- Mini Model - Financing Assumptions

- Mini Model - Other Assumptions

- Mini Model - P&L Projections

- Mini Model - Working Capital

- Mini Model - Interest Schedule + Initial Returns

- The IC Memo Overview

- The IC Memo - Main Components

- Indicative Financing Overview

- Real Lender Indicative Term Sheet Example

- IOI - Indication of Interest Overview

- Real IOI Example

- IOI Accepted - Next Steps

- Conducting Diligence - Overview of Types

- Signaling During Diligence

- Third-Party Providers

- Real Diligence Tracker Example

- Business & Commercial Diligence - Essential Topics

- Real Scope of Work Example - Commercial Diligence

- Real Commercial Diligence Report Example

- Accounting & Tax Diligence - Essential Topics

- Quality of Earnings (QoE) - Important Note

- Common QoE Addbacks

- Real Scope of Work Example - Accounting & Tax Diligence

- Real Financial Diligence Report Example

- Real Tax Diligence Report Example

- Note on the Diligence Process

- Key Data Room Note

- aThe Management Meeting - Associate Responsibilities

- Valuation & Financing - Intro

- Valuation Overview and Underwriting Model Intro

- Underwriting Model - Purpose & Content

- Underwriting Model - Process

- Underwriting Model - Associate/Analyst Role

- Identifying Value Creation Opportunities

- Banana Splits Case - Underwriting Model - Intro

- Model - Intro to Excel

- Model - Cover Pages + Tab Setup + Model Keys

- Model - Setting up for Import

- Model - Unit Data Import

- Model - Prototype Input Build

- Model - Mature Unit Build

- Model - Immature Unit Build

- Model - Unit Build Overview

- Model - Historical Balance Sheet Import

- Model - Driver Dashboard Setup

- Model - Driver Dashboard- New Unit Sensitivities

- Model - Driver Dashboard- Mature Unit Sensitivities

- Model - Linking Drivers to Unit Projections

- Model - Prototype Unit Setup

- Model - Prototype Unit- Quarterly P&L Build

- Model - Prototype Unit - P&L Prep Continued

- Model - Prototype P&L Waterfall Build

- Model - Operating Build Setup

- Model - Operating Build Linking

- Model - Data Import + Formatting

- Model - P&L Build

- Model - Status and Transition

- Model - Sources & Uses Setup

- Model - Sources & Uses + Ownership Build

- Model - Forward LIBOR Curve

- Model - Depreciation & Amort Schedule Setup

- Model - Depreciation & Amort Schedule Build

- Model - D&A Linking + Bridge to Net Income

- Model - Cash Interest and Circular References

- Model - Pro Forma Balance Sheet

- Model - Working Capital Assumptions

- Model - Cash Flow Statement Build

- Model - Cash Flow Available for Debt Service

- Model - Debt Schedule + Revolver Waterfall

- Model - Interest Schedule

- Model - Balance Sheet Metrics and Projections

- Model - Circularity Setup

- Model - Returns Analysis

- Model - Prototype Output

- Model - Covenant Analysis - Debt - EBITDA

- Model - Covenant Analysis - Fixed Charge Coverage

- Lender Model Overview

- Common Covenants Overview

- Debt Commitment Letter - Overview

- Lease Adjusted Debt to EBITDAR - Real Example

- Banana Splits Case - Fixed Charge Coverage Ratio (FCCR)

- Module Overview

- Final IC Memo Overview

- Associate Responsibilities

- IC Memo Example - Preview

- IC Memo Example - Intro

- IC Memo Example - Executive Highlights

- IC Memo Example - Executive Summary

- IC Memo Example - Transaction Overview

- IC Memo Example - Company Overview

- IC Memo Example - Investment Thesis

- IC Memo Example - Model, Returns & Next Steps

- Letter of Intent (LOI) - Overview

- LOI Example - Intro

- LOI Example - Terms

- LOI Example - Financing & Structure

- LOI Example - Distribution Waterfall

- LOI Example - Additional Terms

- LOI Review - Key Considerations

- The Close Process - Intro

- Summary of Items Required to Close

- Final Purchase Agreement - Overview

- Real Purchase Agreement Example - Intro

- Purchase Agreement Example - Definition Highlights

- Purchase Agreement Example - Deal Mechanics

- Purchase Agreement Example - Closing

- Purchase Agreement Example - Reps & Warranties

- Purchase Agreement Example - Wrapping Up

- Purchase Agreements - Key Negotiation Points

- Glossary of Purchase Agreement Terms

- Earnouts Overview

- Escrow + Indemnification + Reps & Warranties

- Purchase Price Adjustments + Breakup Fees

- Termination + Standstill + Oneway (vs Mutual)

- Stock vs. Asset Purchase Agreements

- Final Credit Agreement Overview

- Credit Agreement - Process + Responsibilities

- Types of Covenants

- Credit Agreement Example - Intro

- Credit Agreement - Sliding Fees and Leverage Ratios

- Credit Agreement Example - A Note on EBITDAR

- Credit Agreement - Revolving Facility

- Credit Agreement - Letter of Credit + Term Loan Facilities

- Credit Agreement - General Loan Provision

- Credit Agreement - Closing + Affirmative Covenants

- Credit Agreement - Negative Covenants

- Credit Agreement - Financial Covenants

- Pre-Closing Checklist - Overview

- Regulatory Approvals

- Capital Calls - Overview

- Funds Flow - Overview

- Funds Flow Example

- Portfolio Company Monitoring Overview

- Financial Reporting

- Add-on Acquisitions

- Dividend Recaps

- Exit Timing Considerations

- Future Fundraising

- Example 1 - MOIC Hurdle: Setup

- Example 1 - MOIC Hurdle: Project Level

- Example 1 - MOIC Hurdle: Wrap Up

- Example 2 - Non-compounding Hurdle: Setup

- Example 2 - Non-compounding Hurdle: Project Level

- Example 2 - Non-compounding Hurdle: Tier I

- Example 2 - Non-compounding Hurdle: Tier II

- Example 2 - Non-compounding Hurdle: Wrap Up

- Example 3 - IRR Hurdle: Setup

- Example 3 - IRR Hurdle: Wrap Up

Our students have landed and thrived at positions across all top Wall Street firms, including:

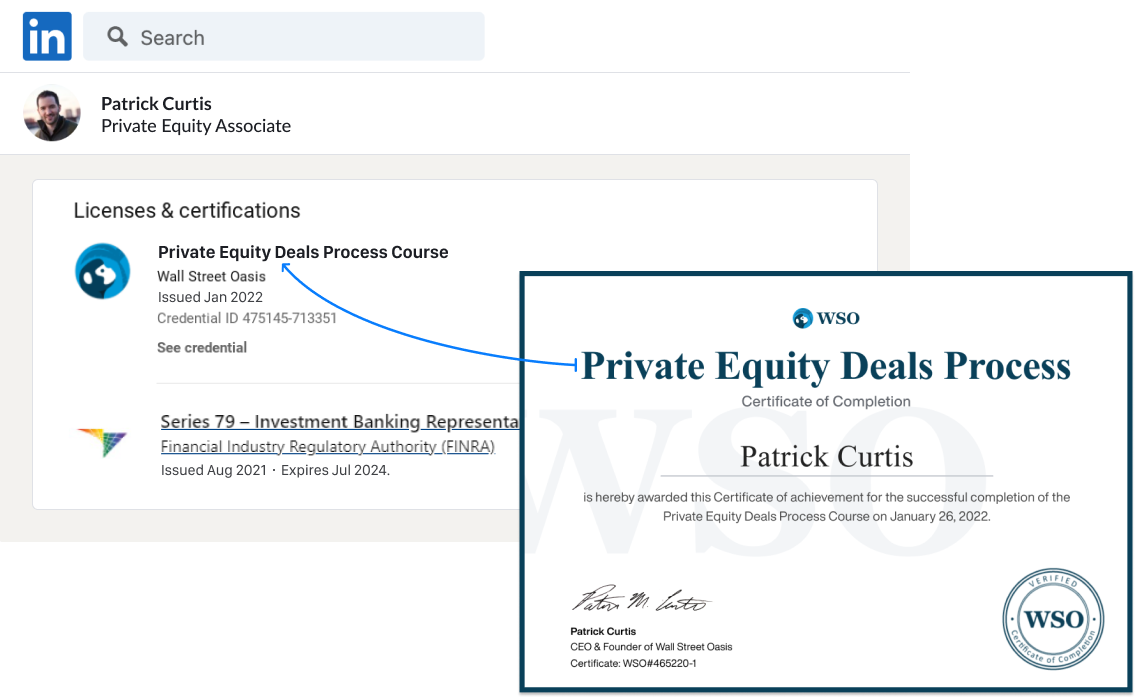

Get the PE Deal Process Course Certification

After completing the course, all students will be granted the WSO PE Deal Process Course Certification. Use this certificate as a signal to employers that you have the technical skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to make yourself an expert on the private equity deal process. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

How Much is Your

Finance Career Worth?

What You Get | Value |

|---|---|

WSO Private Equity Deal Process Course 190+ video lessons across 9 modules taught by finance professionals from top PE megafunds... | $997 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | $300 |

TOTAL VALUE | $1,297 |

Get Unlimited Lifetime Access To The WSO PE Deals Process Course For 76% Off

$1,250

$297

...or get access today for only $109

Secure checkout

100% Unconditional Money-Back Guarantee

12 Month Risk-Free Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee. If, for any reason, you don't think the WSO PE Deals Process Course is right for you, just send us an email, and we'll refund every penny. No questions asked. In short, you get a great return on your investment, or you get your money back. It's that simple.