Financial Modeling & Valuation Bootcamp

Introducing...

An Intense 2-Day Bootcamp to Help You

Build a Strong Foundation in Financial Modeling & Valuation

Limited to 30 Seats

WHAT YOU’LL GET IN THIS VIRTUAL 2 DAY BOOTCAMP

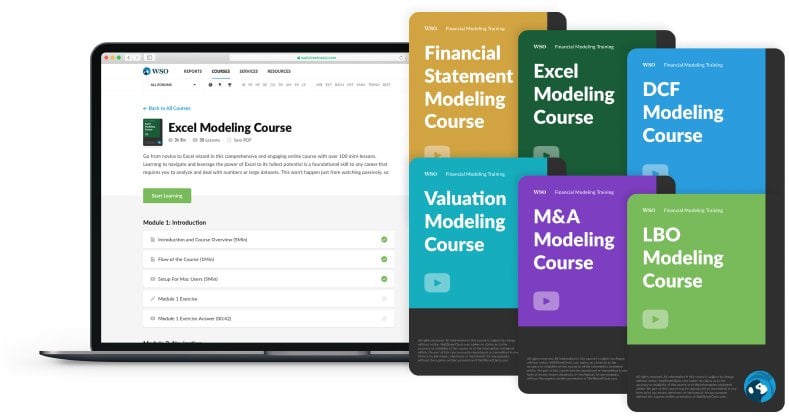

Excel Modeling Course

In this course, we take you from a beginner in Excel to an absolute Excel master with over 100 lessons to help make sure you build a proper foundation for the more advanced financial modeling courses later.

Financial Statement Modeling

In this course, we use 60 video lessons and a case study with Nike, Inc. to walk you through how to build a fully functional 3-statement model. This includes a robust capstone exercise to make sure you are comfortable applying what you learn to any other company.

LBO Modeling Course

In this course, we continue with our Nike, Inc. case study and walk you through a complex LBO Model with over 115 video lessons, and cover critical concepts for private equity professionals. Includes up to date modules on taxes, recaps, rollups and more... so that you can gain every edge and aren't learning from outdated courses.

Valuation Modeling

In this course, we use 170+ video lessons to help give you a strong foundation in both trading comparables analysis and precedent transaction analysis with a realistic case study using Nike Inc. ...so that you can understand the nuances of valuation on the job and how an actual investment banker uses these analyses in the real world…

M&A Modeling

In this course, we use 60+ video lessons to help give you a strong understanding of purchase accounting and modeling for M&A transactions using Nike Inc. as our case study ...so that you can understand the nuances of M&A on the job by learning directly from an elite M&A investment banker…

DCF Modeling

In this course, we use 50+ video lessons to help give you a strong understanding of DCF Modeling using Nike Inc. as our case study and unpacking this common valuation methodology so that you can truly understand both the theory and practical uses for the job…

WSO Financial Modeling & Valuation Bootcamp - Video Preview

Topics Covered - Day 1

Below you will find a list of the topics covered on Day 1 of the Financial Modeling & Valuation Bootcamp.

- About Your Instructor and Attendees

- Bootcamp Course Objectives

- Additional Resources

- Key Excel Skills for Financial Modelling

- Navigation (shortcuts, hotkeys)

- Formatting (best practices, custom formatting)

- Formulas (math, date, error functions)

- Three Financial Statements

- The Big Picture (income statement, balance sheet, cash flow statements)

- Target Outputs (model setup, ratios, scenario, data table analysis)

- Date Headers

- Historical Income Statement

- Income Statement Drivers

- Income Statement Projections

- Historical Balance Sheet

- Working Capital Schedule

- Summary Overview

- Inventories

- Accounts Receivable

- Accounts Payable

- Other Current Assets (e.g. prepaid expenses)

- Other Current Liabilities (e.g. accrued liabilities)

- PP&E and Intangibles Schedule

- Historical items

- Drivers

- Projections

- Historical Cash Flow Statement

- Cash Flows from Operations

- Cash Flows from Investing Activities

- Cash Flows from Financing Activites

- Equity Schedule (Retained Earnings)

- Dividends

- Cash Available for Debt Pay-down

- Long Term Debt

- Revolver

- Interest

- Circularity

- Historical Shares

- Dilutive Securities

- EPS Calculation

- Projected Shares Outstanding

- Share Repurchases

- New Circular Reference

- Options Proceeds

- Understanding interconnectivity of statements

- Understanding IFRS-16

- Wrapping Up

- Valuation Roadmap

- Conceptual Framework for Company Value

- Intrinsic versus Relative Valuation

- Simple Example of Valuation Thought Process

- Valuation Methodologies (Trading Comps, Transaction Comps and DCF)

- Introduction to Equity Value

- Example of Simple Equity Value Calculation

- Introduction to Enterprise Value (Firm Value)

- Example of Equity Value to Firm Value Bridge

- Practical Example

- Revisiting Home Purchase Price Example

- Summary, Reflections, and Calculations

- Overview

- Examples of What Affects Firm Value

- Firm Value Relationship with Capital Structure

- Firm Value & Equity Value Practice Examples

- Other Activities Impacting Firm Value

- Introduction to Firm Value and Equity Value Multiples

- Common Metrics that Pair with Firm Value and Equity Value

- Summary, Reflections, and Calculations

- Quiz Checkpoint and Q&A

Topics Covered - Day 2

Below you will find a list of the topics covered on Day 2 of the Financial Modeling & Valuation Bootcamp.

- Overview

- Introduction to Trading Comps

- P&L Terminology

- P&L in Valuation

- Firm Value and Equity Value Metrics

- Commonly Used Multiples

- Considerations

- Examples

- Illustrative Outputs

- Analyst FAQ

- Overview

- Selecting a Universe of Peers

- Practical Example

- Locating Relevant Financial Information

- Preparing LTM Metrics

- Calendarisation

- Fully Diluted Shares and Example

- Options & Warrants and Example

- Converts & Other Securities and Example

- Restricted Stock and Other Dilutive Securities

- Additional Analysis Considerations

- Introduction to Trading Comps Excel Template

- Overview

- Terminology

- Common Valuation Multiples

- Control Premium

- Introduction to Synergies

- Examples

- Summary and Reflections

- Process

- Identifying Precedent Transactions

- Sample Fairness Opinion Excerpt

- Other Deal-Specific Dynamics

- Transaction Comparables Examples

- Other Potential Precedent Transactions Considered

- Locating Relevant Deal Terms and Financials

- Spreading Metrics

- Introduction to Transaction Comps Excel Template

- Overview

- Terminology

- Terminology in Valuation

- Preparing Financial Metrics

- Unlevered versus Levered Free Cash Flow

- Calculating Net Working Capital

- Terminal Value

- WACC

- Summary and Reflections

- Process

- Bridging from FV to EV in a DCF

- Additional Considerations

- Basic FDSO Exercise

- Calculating Dilutive Impacts

- Conduction Sensitivity Analyses

- Triangulating Valuation

- Trading Comparables

- Transaction Comparables

- DCF Valuation

- LBO (Floor) Valuation

- Introduction

- The Big Picture

- M&A Players and Creation of the M&A Process

- Buy-side Processes

- Sell-side Processes

- Setup and Modelling

- Valuation, Transaction Assumptions, and Sources & Uses

- Balance Sheet and Transaction Adjustments

- Accretion and Dilution

- P&L Projections for Full-blown Accretion Dilution Analysis

- Sensitivity Analysis

- Sell-side Accretion Dilution

- Quiz Checkpoints and Q&A

Our customers have landed positions at all top Wall Street firms, including:

Don’t Take Our Word For It

Hear from a few of our 57,000+ students...

Hear from a few of our 57,000+ students...

"Compared to other courses, these courses overall gave a much better context of when and how modeling is used, and what cash truly represents, which is something I learned the hard way. I found the instructions in the courses to be very clear. I'd definitely recommend anyone looking to take a comprehensive course on financial modeling."

"Shooting you a quick note because I just got my full-time offer and I wanted to say THANK YOU! I have to say the instructors for these courses are super talented. From Excel to financial statements to Valuation I was really able to go into my internship ready to go and more confident after taking the time to go through these."

"I'd taken another Excel course before but this was much more relevant to me since I was trying to break into investment banking when I took it. I love that you can download the lessons for offline viewing on my commute...thanks for putting this together WSO!"

"Glad to say that this has definitely been one of the more detailed Valuation courses yet. Very useful to see how 'spreading comps' is applied to Companies from many different areas ranging from fashion to wearable tech to luxury brands. Good to see the objectives outlined early on and sufficient introductory lessons to ensure newcomers are able to get up to speed with ease."

"Guys, this Excel Modeling course was awesome because it made Excel fun (or at least much less painful). Even though in my internship they rarely let us touch the models, I definitely think this course helped me impress the analyst I was working with most of the summer and helped me secure a full-time offer. When he asked me to organize some data in Excel for a buyer universe, I think he was pleasantly surprised that I turned it around in under 2 hours and had it beautifully formatted with some bells and whistles. You guys rock, thank you!"

"Regarding the Financial Statement Modeling course, I don't have a traditional finance background and have had limited exposure to financial statements so this was all very new, but necessary and fun for me to learn. I really like Zack as a teacher, he is relatable and takes these somewhat daunting concepts, and breaks them down into easy-to-digest pieces that make the experience fun and enjoyable. The ability to rewatch and relearn the topics on this module was really helpful. My favorite part of the module, however, was the capstone project. It's a great exercise and to put together a financial model on my own, knowing I can go back to these videos for help, is really empowering, especially as a student. The detail and the care that was put into it really stood out, and I know that I have learned amazing skills from this that are going to help me in my internship this summer, but also long after I graduate university. This is a great course 10/10 would recommend!"

"I took the Excel Modeling course as a way to try and get faster in Excel and I have to say it has made a big difference. Not that I'm the traditional student since I'm a bit more senior role at a Big 4, but it was still really helpful for me and made me more confident when reviewing work from clients and my team. I don't think I need the other financial modeling courses since I'm happy with my role, but you never know. Thanks WSO, keep it up!"

"Regarding the Excel Modeling Course, I thought I was an Excel whiz before, but now I know I am because I was able to do the exercises fast enough... but it did take some time. The lessons on conditional formatting, pivot tables, etc were also all relevant to what I did in my F500 internship and my boss definitely noticed my skills when I didn't touch my mouse. I'm excited to try and land an IB internship next year."

"I'm very impressed with the Excel Modeling course! What stands out to me the most is how much knowledge is packed into such a small timeframe. Other courses with this level of detail are ~3-4 times as long. I'm really happy that I've taken this course and do believe that, whether you are a university student/intern or an entry-level professional, you can certainly get some value from this. Unlike other courses online this one you can do over the weekend and bring those new skills to work on Monday."

"The Financial Statement Modeling course is an excellent resource for aspiring or incoming financial analysts. This course pairs excellently with the WSO Excel Modeling course. The two combine to form a powerful training program that I would highly recommend for all aspiring/incoming financial analysts, particularly those interested in investment banking. Zack, the instructor, does an excellent job of walking you through the entire process in an efficient manner that touches on all the important aspects without getting bogged down in the details too much. I cannot recommend this course more highly!"

"I thought it was one of the most informative valuation modeling courses I have taken. I would recommend this course over others I have taken."

"The Wall Street Oasis Valuation course is by far the most in-depth look at valuation I have come across in my academic/professional career. The course goes far beyond the basic concepts taught in the classroom and gives you a front-row seat into what an analyst does on the job and how they value a business in the real world. You'll learn the best practices to become a high-performing analyst and you're provided with plenty of real-world examples to practice with. If you're interested in a career in investment banking/valuation there's no better resource out there to get you ready to hit the ground running and give you a head start on the competition."

Get 6 Distinct Course Certifications

After completing each course, all students will be granted a WSO Modeling Certification for that specific course. Use these certificates as a signal to employers that you have the technical modeling and valuation skills to immediately add value to your team.

After completing each course, all students will be granted a WSO Modeling Certification for that specific course. Use these certificates as a signal to employers that you have the technical skills to immediately add value to your team.

How Much is Your

Finance Career Worth?

What You Get | Value |

|---|---|

WSO Financial Modeling & Valuation Interview Bootcamp 2 days, 16 hours of live instruction gives an intense and focused plan to drill down the material | $1997 |

WSO Excel Modeling Course 110+ video lessons across 13 Modules taught by a top-ranked bulge bracket investment banker... | $97 |

Financial Statement Modeling Course 60+ video lessons across 9 Modules taught by a top-ranked bulge bracket investment banker... | $197 |

LBO Modeling Course 115+ video lessons across 14 Modules taught by a top-ranked megafund private equity associate... | $297 |

Valuation Modeling Course 170+ video lessons across 19 Modules taught by a Top-ranked BB investment banker + an elite PE pro... | $197 |

M&A Modeling Course 60+ video lessons across 10 Modules taught by an elite M&A investment banker... | $197 |

DCF Modeling Course 50+ video lessons across 7 Modules taught by a top-bucket bulge bracket investment banker... | $97 |

Bonus 1: 18 Mini Courses (Lifetime Access) + WSO Video Library (12mo Access) Access to 100+ videos including 18 mini courses (avg 3hrs of content each!) | $497 |

Bonus 2: WSO Company Database (WSO Premium) - 12 Month Access 24,681+ interview insights, 51,233+ exclusive salary and bonus datapoints + 20,127 company reviews... | $297 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | 197 |

6 Months of FREE Access to Macabacus Full access to this Excel plug-in that makes financial modeling even easier, including tools for PowerPoint and Word. | $120 |

TOTAL VALUE | $4190 |

Get Unlimited Lifetime Access To The Elite Modeling Package + Attend the 2-Day Financial Modeling and Valuation Virtual Bootcamp For 76% Off

$4,190

$997

Secure checkout

Frequently Asked Questions

Top professionals with IB, Corporate Development and PE experience. The faculty in charge of leading this bootcamp includes:

- Current Vice President with over 7 years experience at a Bulge Bracket Investment Bank

- Senior Manager in Business Dev at a F100 with 7 years experience working in IB, PE and Corporate Development/M&A

- MBA Students and Business Undergraduates

- Incoming Investment Banking Associates and Analysts

- Investment Banking Analysts and Associates

- Incoming Private Equity/Hedge Fund Associates and Analysts

- Private Equity/Hedge Fund Associates and Analysts

- Corporate Finance Professionals

- Taught and vetted by actual industry professionals

- Course content continuously reviewed and updated

- Prepare to excel across all aspects of the Financial Modeling & Valuation

- Understand key financial modeling theory, mechanics and apply them in practice

- Please check out our Events page for more details

- Live-instruction conducted through Zoom

- Elite Modeling Package lifetime access granted upon reserving your seat