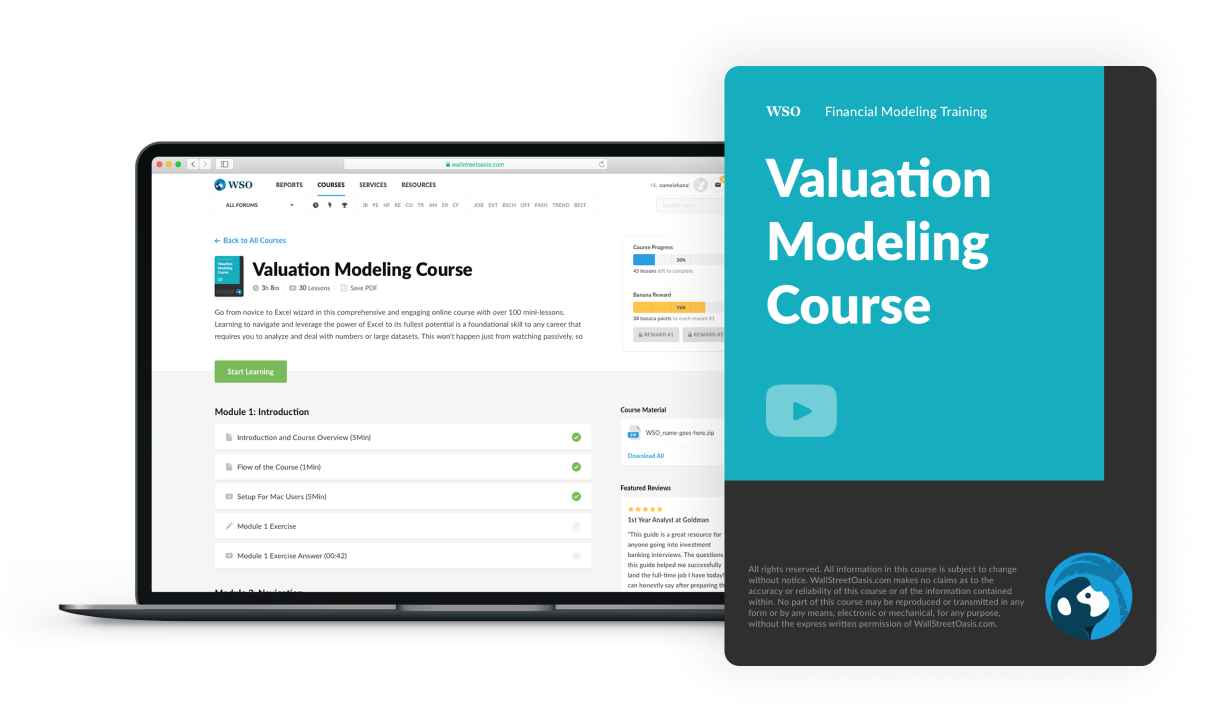

VALUATION MODELING COURSE

Introducing...

170+ Lessons, 10+ Exercises and Real Cases

To Help You Thrive in the Most Prestigious Jobs on Wall Street...

HERE’S JUST SOME OF WHAT YOU’LL GET IN THIS COURSE

The Big Picture (13 video lessons, 2 examples)

In this module, we use 13 video lessons to go through the theory and logic behind Valuation. This knowledge is then put into practice with a true case and robust valuation analysis of Nike, Inc.

Enterprise Value & Equity Value Practice (10 video lessons, 2 examples)

In this module, we use 10 video lessons to explore enterprise value and equity value, a bit more in-depth by applying the knowledge we gained so far across a number of practice exercises.

Trading Comps Intro (20 video lessons, 4 examples)

In this module, we use 20 video lessons where we will perform a much deeper dive into trading comps. We give a review of key concepts, an in-depth focus on enterprise value and equity value multiples, and apply it through a couple of practice examples, with company filings and data.

Trading Comps Set-Up (22 video lessons)

In this module, we use 22 video lessons to do a much deeper dive into how to set up trading comps. First, we cover a step by step process for building comps, then we give you a walk-through of an excel-based trading comps template, and finally set the foundation for our case study with a real company.

Spreading Real Firms (5 modules, 40 video lessons)

In these 5 modules, we use 40 video lessons to provide a step-by-step guide to building out trading comps across 4 real companies. We input assumptions and make adjustments for each comp and then roll up this analysis into a summary tab.

Benchmarking and Outputs (2 video lessons)

In this module, we summarize and benchmark the outputs from our trading comps. This is a summary of all the comps we've spread to give you a deeper understanding of how to interpret the final results as a true professional would.

Precedent Transactions Introduction (8 video lessons)

In this module, we use 8 video lessons to introduce you to the theory behind precedent transactions. We also give you 2 examples of how to execute this challenging analysis with ease.

Precedent Transactions Setup (12 video lessons)

In this module, we use 12 video lessons to show you how to setup a precedent transaction analysis using a step-by-step process. Selecting a peer group, locating relevant financial info, spreading key financial metrics, benchmarking a peer group and more.

Real Transactions (6 modules, 43 video lessons)

In these 6 modules, we use 43 video lessons to spread the transaction comps for 6 real-world acquisitions. We review acquisition considerations for all of them and show you how to execute a precedent transaction analysis like you would on the job.

Transaction Outputs & Wrap-Up (3 video lessons)

In this final module, we summarize and benchmark the outputs from our transaction comps. This is a summary of the full analysis from the work done in previous modules and helps you interpret the results as a true professional would.

WSO Valuation Modeling Course - Video Preview

Course Summary - Table of Contents

Below you will find a list of the modules and lessons included in this course.

- Welcome to Valuation!

- Introduction and Course Overview

- Valuation Road Map

- Big Picture: Valuation Thought Process Across Use Cases

- Valuation Foundation - Intro to Equity Value

- Valuation Foundation - Intro to Enterprise Value

- Market Value of Equity vs. Book (Accounting) Value of Equity

- Introductory Exercise: Calculating Nike's Market-Implied Enterprise Value

- Module Summary & Conclusion

- Enterprise Value & Equity Value Practice Module Overview

- What Affects Enterprise Value?

- Key Theme: Enterprise Value & Capital Structure Independence

- Key Theme: Enterprise Value & Equity Value Multiples

- Key Theme: Metrics to Tie with EV and Equity Value

- Module Summary & Conclusion

- Trading Comps Intro Module Overview

- P&L Terminology Used in Valuation

- How P&L Items Impact and are Reflected in Valuation

- Which Multiple to Use?

- Commonly-Used EV Multiples & Key Considerations

- Commonly-Used Equity Value Multiples & Key Considerations

- Calculating Enterprise Value Multiples Examples

- Calculating Valuation Multiples for Lululemon

- Calculating Valuation Multiples for Nike

- Sample Trading Comps Analysis Outputs

- Analyst FAQs

- Sector-specific EV multiples

- Module Summary & Conclusion

- Trading Comps Setup Module Overview

- Selecting a Universe of Comparable Companies

- Locating the Necessary Financial Information

- Additional Trading Comps Considerations: LTM Financial Data

- Additional Trading Comps Considerations: Annualization / Calendarization

- Additional Trading Comps Considerations: Fully-Diluted Shares Outstanding ("FDSO")

- Calculating the Dilutive Impact from Stock Options & Warrants

- Calculating the Dilutive Impact from Converts & Other Securities: Convertible Debt

- Calculating the Dilutive Impact from Converts & Other Securities: Convertible Debt (cont'd).

- Calculating the Dilutive Impact from Converts & Other Securities: Convertible Preferred Stock

- Calculating the Dilutive Impact from Converts & Other Securities: Convertible Preferred Stock (cont'd.)

- Calculating the Dilutive Impact from Converts & Other Securities: RSUs & Other Dulutve Activity

- Additional Trading Comps Considerations: Adjusting for Non-Recurring Items

- Comps Analysis Template Preview

- Module Summary & Conclusion

- Module Overview

- Inputting & Interpreting Nike's Historical Financial and Projected Performance

- Inputting Nike's Capital Structure, Selected Balance Sheet Data & Credit Profile (Credit Statistics)

- Calculating Nike ROIs (Dividend Yield, ROIC, ROE, ROA)

- Calculating Nike Shares Outstanding

- Calculating Nike Fully Diluted Shares Outstanding with Options and RSUs

- Calculating Nike's Market-Implied Valuation Multiples

- Nike Summary & Reflections

- Module Overview

- Inputting & Interpreting Adidas' Historical Financial and Projected Performance

- Inputting Adidas' Capital Structure, Selected Balance Sheet Data & Credit Profile (Credit Statistics)

- Calculating Adidas ROIs (Dividend Yield, ROIC, ROE, ROA)

- Calculating Adidas Shares Outstanding

- Calculating Adidas Fully Diluted Shares Outstanding with Options and RSUs

- Calculating Adidas' Market-Implied Valuation Multiples

- Adidas Summary Observations & Reflections

- Module Overview

- Inputting & Interpreting LULU's Historical Financial and Projected Performance

- Inputting LULU's Capital Structure, Selected Balance Sheet Data & Credit Profile (Credit Statistics)

- Calculating LULU ROIs (Dividend Yield, ROIC, ROE, ROA)

- Calculating LULU Shares Outstanding

- Calculating LULU Fully Diluted Shares Outstanding with Options and RSUs

- Calculating LULU Market-Implied Valuation Multiples

- LULU Summary Observations & Reflections

- Module Overview

- Inputting & Interpreting UA's Historical Financial and Projected Performance

- Inputting UA's Capital Structure, Selected Balance Sheet Data & Credit Profile (Credit Statistics)

- Calculating UA ROIs (Dividend Yield, ROIC, ROE, ROA)

- Calculating UA Shares Outstanding

- Calculating UA Fully Diluted Shares Outstanding with Options and RSUs

- Calculating UA Market-Implied Valuation Multiples

- UA Summary Observations & Reflections

- Benchmarking the Comps and Determining the Valuation through Comparable Companies Analysis

- Producting Dynamic Outputs: Benchmarking and Trading Multiples

- Producting Dynamic Outputs: Football Field

- Transaction Comps Intro Module Overview

- Common Precedent Transaction Valuation Multiples

- The Concept of Control and the Control Premium

- Synergies

- Basic Precedent Transactions Example

- Module Summary & Conclusion

- Transaction Comps Intro Module Overview

- Common Precedent Transaction Valuation Multiples

- The Concept of Control and the Control Premium

- Synergies

- Basic Precedent Transactions Example

- Module Summary & Conclusion

- Precedent Transactions Setup Module Overview

- Screening for & Selecting the Universe of Precedent Transactions

- Other Deal-Specific Dynamics

- Other Potential Precedent Transactions Considered for Case Study

- Locating the Necessary Deal Terms and Target Financials

- Spreading Key Operational & Financial Metrics, Transaction Multiples and Premiums Paid

- Introduction to Transaction Comps Excel Template

- Module Summary & Conclusion

- Inputting Deal Terms

- Calculating Fully Diluted Shares Outstanding

- Inputting Selected Balance Sheet Data and Historical Financials

- Inputting Non-GAAP Adjustments and Projections

- Benchmarking the Precedent Transactions

- Precedent Transaction Summary & Reflection

- Inputting Deal Terms

- Calculating Fully Diluted Shares Outstanding

- Inputting Selected Balance Sheet Data and Historical Financials

- Inputting Non-GAAP Adjustments and Projections

- Benchmarking the Precedent Transactions

- Precedent Transaction Summary & Reflection

- Inputting Deal Terms

- Calculating Fully Diluted Shares Outstanding

- Inputting Selected Balance Sheet Data and Historical Financials

- Inputting Non-GAAP Adjustments and Projections

- Benchmarking the Precedent Transactions

- Precedent Transaction Summary & Reflection

- Inputting Deal Terms

- Calculating Fully Diluted Shares Outstanding

- Inputting Selected Balance Sheet Data and Historical Financials

- Inputting Non-GAAP Adjustments and Projections

- Benchmarking the Precedent Transactions

- Precedent Transaction Summary & Reflection

- Inputting Deal Terms

- Calculating Fully Diluted Shares Outstanding

- Inputting Selected Balance Sheet Data and Historical Financials

- Inputting Non-GAAP Adjustments and Projections

- Benchmarking the Precedent Transactions

- Precedent Transaction Summary & Reflection

- Transaction Comps Benchmarking & Outputs

- Overall Relative Valuation Benchmarking & Outputs

- Adjusting for Non-Recurring Items

- Adjusting for Non-Recurring Items

- Adjusting for Non-Recurring Items

- Adjusting for Non-Recurring Items

- Adjusting for Non-Recurring Items

Our students have landed and thrived at positions across all top Wall Street firms, including:

Don't Take Our Word For It

Hear From Our Students

Wall Street Oasis has trained over 63,000 students at elite corporate and educational institutions for over a decade.

Get the Valuation Modeling Course Certification

After completing the course, all students will be granted the WSO Valuation Modeling Course Certification. Use this certificate as a signal to employers that you have the technical Valuation skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to make yourself a master in executing comparable company and precedent transaction analyses. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

How Much is Your

Finance Career Worth?

What You Get | Value |

|---|---|

WSO Valuation Modeling Course 170+ video lessons across 19 Modules taught by a top-bucket bulge bracket investment banker... | $500 |

10 Interactive Exercises with Real Financials Practice what you'll do on the job with detailed exercises spreading the financials of 10 companies | $450 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | $300 |

TOTAL VALUE | $1,250 |

Get Unlimited Lifetime Access To The WSO Valuation Modeling Course For 84% Off

$1,250

$197

...or get access today for only $77

Secure checkout

100% Unconditional Money-Back Guarantee

12 Month Risk-Free Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee. If, for any reason, you don't think the WSO Valuation Modeling Course is right for you, just send us an email, and we'll refund every penny. No questions asked. In short, you get a great return on your investment, or you get your money back. It's that simple.